On March 15, iHeartCommunications commenced private offers to eligible lenders under its Term Loan D and Term Loan E facilities to amend the existing term loans and exchange them for new securities of iHeartMedia and CC Outdoor Holdings and/or iHeart Communications.

Just after 9pm Eastern on April 5, the company said the term loan offers would expire at 5pm Eastern on April 14, allowing for a one-week extension.

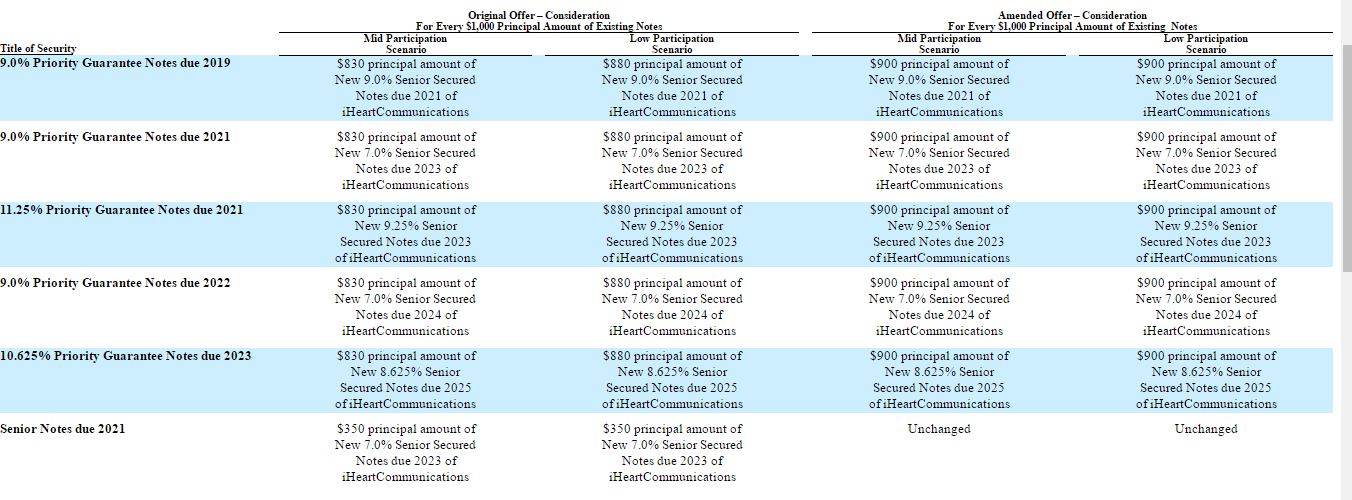

At the same time, iHeart extended to April 21 the private offers to holders of certain series of iHeartCommunications’ outstanding debt securities to exchange the existing notes for new securities of CC Outdoor Holdings, iHeartCommuncations, and iHeartMedia.

On Thursday (4/13), a second extension was given.

More importantly, iHeart is amending the private offers to lenders under its Term Loan D and Term Loan E facilities.

This is being done to “increase the ratio of amended term loans to Existing Term Loans,” iHeart said.

Now, the term loan offers were previously scheduled to expire on April 14, 2017, at 5:00 p.m., New York City time, and will now expire on April 21, 2017, at 5:00 p.m., New York City time.

The amendments and extensions to the Term Loan Offers will be set forth in a Supplement No. 4 to the Confidential Information Memorandum dated April 13, 2017 (as amended or supplemented from time to time, the “Confidential Information Memorandum”). The amendments will increase the ratio of amended term loans to Existing Term Loans as set forth below:

What does the amendment to the term loan offers accomplish?

The consideration being offered in the “Mid Participation Scenario” is now the same as the consideration being offered in the “Low Participation Scenario,” as iHeart sweetens its offer to interested parties.

The consideration being offered in the High Participation Scenario or the Term Loans Only Scenario has not been amended.

The term loan offers are only available to holders of existing term loans and are exempt from registration under the Securities Act of 1933.