Comcast Corp. has commenced a private offer to exchange new series of Comcast senior notes for up to $4 billion in aggregate principal amount of certain series of existing Comcast and NBCUniversal notes.

Translation: The MVPD giant that owns Universal Studios; all networks under the NBC and Telemundo banner; and all broadcast and pay-TV stations carrying NBCU programming wants to exchange old debt for new debt.

This debt extends out some 35 years.

Comcast made the announcement after the Closing Bell on Wall Street Tuesday.

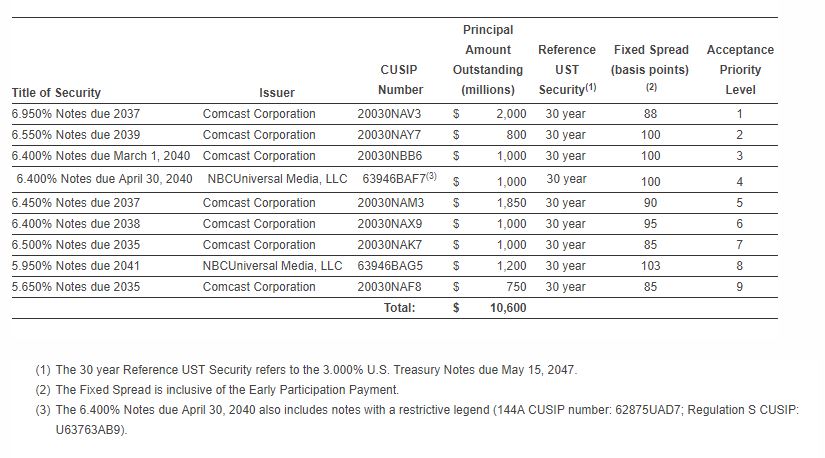

Subject to the Old Notes Cap, the aggregate principal amount of Old Notes that are accepted for exchange will be based on the order of acceptance priority for such series as set forth in a table, which appears below.

The “Acceptance Priority Levels” are established so that the aggregate principal amount of Old Notes accepted in the Exchange Offer results in the issuance of new notes due November 1, 2047 in an aggregate principal amount not exceeding $2 billion; new notes due November 1, 2049 in an aggregate principal amount not exceeding $2 billion; and new notes due November 1, 2052 in an aggregate principal amount not exceeding $1.5 billion.

An Early Participation Date of Oct. 17 has been established, and the early participation payment will be $30 per $1,000 principal amount of Old Notes. It will be paid in the form of New Notes.

The exchange offer will expire at 11:59pm Eastern on Oct. 31, and is subject to certain conditions. For instance, if less than $500 million of New 2047 Notes would be issued, then no New Notes will be created — and the Exchange Offer will be terminated.

In addition, if less than $500 million of New 2049 Notes or New 2052 Notes would be issued, then no notes of such series will be created.