|

|

|

Volume 22, Issue 76, Jim Carnegie, Editor & Publisher

|

Monday Morning April 18th, 2005

|

|

|

Radio News®

|

Hostile bidder targets Interep Hostile bidder targets Interep

Oaktree Capital Management already owns over 2% of the stock of Interep and owns more of the radio rep firm's public bonds, but it wants more - - it wants control of the company and the ouster of founder and CEO Ralph Guild. After being rebuffed in its approach to Guild and the board of directors, Oaktree went public after the market closed on Friday, releasing a letter it sent to each Interep director urging a financial restructuring and claiming that Guild is "in a state of denial" regarding Interep's financial condition. It also charged that Guild is overpaid - - noting that his 1.1 million in annual compensation amounts to 15% of the company's current market capitalization - - and receives perks that create "an aura of extravagance." It also questioned why a 76-year-old has a contract running for another seven years, inferring that a younger CEO is needed to rebuild the company. In response, Guild told RBR/TVBR that Interep has retained an investment banker to advise it on a bond refinancing, but he wants nothing to do with the proposal from Oaktree. "They want to crush the existing shareholders down to almost nothing to benefit themselves," he said. Instead, Interep is in talks with other companies about deals which would inject new equity into the company without wiping out current shareholders, who are mostly Interep employees. As for the attacks on him, Guild said that is typical of the way Oaktree operates. But he said they can do nothing except complain because Interep is current on its financial obligations. "We have more than enough cash to get through this year and next year," he said, adding, "fortunately, business is good." He also scoffed at the comments about his age and said he has no plans to retire. Guild agreed that there was some truth to Oaktree's contention that some radio groups would be more willing to take their business to Interep if the company had a better balance sheet, but he said that has never actually come up in client negotiations.

RBR observation: Ralph Guild has learned the hard way the downside of being a public company. With its stock price in the tank, it's not surprising that a vulture capital firm is making a play for Interep. But with Guild and company employees owning more than 70% of Interep's stock, it's hard to see how Oaktree could pull off what is essentially a hostile takeover bid. This now-public dispute with a major bondholder is going to be another distraction as Interep tries to get its financial house in order, sell more advertising and get back to profitability. Guild and his upper management have to rethink an entire business strategy and put together a solid business plan that brings a little radio rep firm into the 21st century. In other words not just selling national spots as Interep will have to think 2010 but deploy the action in 2005 or the outlook for 2010 is not pretty as the world is moving fast and its rep competitor of Clear Channel's Katz-Media is a bigger animal with more resources. The key when you are a small firm is plan big by leveraging all your strengths and tools at your finger tips. It is not easy trust us because if it were then everyone would do it. Key now is Interep to get the word to clients and hope nobody bolts to the competition or as there has been water cooler talk of cutting ties and some groups forming their own representation with national business. Time to plan your work and work the plan as time is never on anyone's side it just keeps ticking.

Heres the official letter from Oaktree

Final word: No Nielsen role Final word: No Nielsen role

in Houston PPM test

After months of negotiations over whether Nielsen Media Research would take part in the Portable People Meter (PPM) test that Arbitron has already begun deploying in Houston, the final decision came down Friday: no. Arbitron says that with the PPM test already ramping up, by the time Nielsen could make a decision on whether to join in, the test would already be up and running and generating ratings data. So, Arbitron says it has withdrawn its invitation for Nielsen to participate in the Houston test. Instead, according to Arbitron, Nielsen will now focus its PPM a more detailed examination of the PPM's audio detection capabilities (since all data collection is based on audio encoding) and on the business, research and financial issues of a potential PPM joint venture with Arbitron. RBR/TVBR got this brief comment from a Nielsen spokesman: "The Arbitron report accurately describes our priorities." Here's the email that Arbitron's President, PPM and International, Pierre Bouvard, sent to clients. See RBR Radar below

|

|

|

Radio hot, TV not at Journal Communications

Journal Communications CEO Steve Smith complained of soft ad demand for the company's TV stations and newspapers in Q1. But radio was a bright spot, with revenues up 9.2% to 18.2 million and operating earnings up 22.6% to 3.8 million. TV revenues were up 5.8% to 19 million, but that was all due to the acquisition of WGBA-TV (Ch. 26, NBC), which added 2.1 million in revenues. Absent that, revenues would have been down about a million bucks - - largely due to the lack of political advertising this year. For the entire company, Q1 revenues were up 1.3% to 181.4 million and operating earnings fell 17.1% to 21.3 million. Looking ahead, Journal is expecting continued growth in radio and hoping for a rebound in national advertising demand to help TV later in the year. So, what's driving that strong radio growth? "In radio, where we have done well is generally linked to our developmental markets. We've continued to do well in the ratings - - there are solid platforms to build on. As we continue to grow in markets like Tulsa, Springfield and Knoxville, we're doing well in our mature markets as well," said Journal Broadcast Group CEO Doug Kiel told the analysts. But despite growing revenues more than 9% in Q1, Kiel isn't raising the bar. He still expects radio growth for all of 2005 to be in the mid single digits.

Anonymous VNRs Anonymous VNRs

shot down in the Senate

Amendment: "Unless otherwise authorized by existing law, none of the funds provided in this act or any other act may be used by a federal agency to produce any prepackaged news story unless the story includes a clear notification within the text or audio of the prepackaged news story that the prepackaged news story was prepared or funded by that federal agency." For: 98. Against: 0. The amendment, sponsored by Sen. Robert Byrd (D-WV) was attached to a supplemental spending bill. Noting existing statute, Byrd said, "Yet, despite the law, the Congress and the American people continue to hear about propaganda efforts by Executive Branch agencies." Byrd cited several incidents of alleged propaganda, including the Armstong Williams incident and use of VNRs. He noted the FCC's reminder to broadcasters to properly identify VNR producers, and said Congress should make the rules equally clear for federal agencies. Passage of the amendment would appear to head off attempts to consider similar legislation in the Senate Commerce Committee, an effort inititated by a quarter of Democrats including John Kerry (D-MA), Frank Lautenberg (D-NJ), Byron Dorgan (D-ND) and Barbara Boxer (D-CA). President Bush addressed the topic himself in an appearance with the American Society of Newspaper Editors. He agreed that proper sourcing was a must, but laid the onus on those airing the VNRs, not those producing them.

Transaction outlook: 2005, Part 5 Transaction outlook: 2005, Part 5

What kind of deals are going to get done this year? It seems everything is still kind of up in the air, especially for TV, but even somewhat for radio as far as rules," we asked Elliot Evers of Media Venture Partners. "We are assessing [radio] markets based on the Arbitron rules, rather than the contour rules, so that much we know. The government decided not to take the ownership rules to the Supreme Court; that was not good. So what's 2005 going to be like? I think there will be more radio inventory than there has been. We're already seeing more, for different reasons, people bringing things to market whether because of a little bit of top line softness they can't quite hit their target numbers, or regulatory dispositions, or people have excessive costs." What's television trading going to be like this year? "A lot more unsettled situation. I think there could be as much television inventory as one could imagine. There are dozen and dozens of stations that kind of want to be sold, but the buyer appetite there is a lot more limited. It's just a tough, tough television environment. I'd say that the sellers kind of want 12 times the '04 political boosted cash flow and the market kind of wants to pay 10 or 10 and a half. It's tough to get deals done on television now. I think you'll see deals in all market sizes. The lack of clarity on the ownership rules, particularly with regards to small or even mid-market duopoly is critical, it's just crippling. There are so many markets where we have the television station billing, let's say two to three million dollars a year, that is limping by - - doing okay in a political year and doing not so okay in a non-political year. You know that station should really be combined with a companion station."

|

|

|

|

| Conference Calls Q4 2004 |

Tribune broadcast slumped in Q1

Broadcasting and Entertainment revenues dropped 5.6% to 310 million at Tribune Company. Radio/Entertainment slumped 9.7% to 20.1 million and TV was off 5.3% to 290.1 million. Radio/Entertainment also saw a big jump in costs, primarily due to 13.5 million of additional compensation related to the Chicago Cubs' Sammy Sosa trade. On the TV side, the company said ad revenue declines were primarily driven by weakness in the automotive, movie and telecom categories. That's in addition to the impact of Local People Meters on the Tribune stations' ratings in New York, Los Angeles, Chicago and Boston (see related story). Publishing revenues were flat at one billion bucks, although ad sales were up 2%. For the entire company, Q1 revenues were down 1% to 1.32 billion. Excluding one-time items, earnings were 41 cents per share - - in line with the Thomson/First Call consensus. There was concern in Tribune's conference call about how it is dealing with a recently announced ad boycott of the Los Angeles Times by General Motors (4/11/05 RBR #71). "As far as the GM situation, we've got multiple points of contact at different levels with General Motors. The LA Times is responding in a thoughtful way to make sure that if there were any factual errors, that they will be corrected, but there is no indication at this point that is the case," said Tribune CEO Dennis FitzSimons.

Emmis: Corrections

There were a couple of errors in our story on Emmis Q4 results Friday. Its fiscal Q4 political revenue was 5.6M dollars a year ago, and it dropped to 500K dollars for the just-completed Q4. Both numbers represent single quarter, not full-year results. Also, four radio stations are currently broadcasting in high-def, and 17 total (as opposed to 17 additional) stations are slated to be in HD by June 2007.

|

|

|

|

|

Adbiz©

|

Hispanic Advertising Foundation launched

The Association of Hispanic Advertising Agencies (AHAA) has launched the first Hispanic Advertising Foundation. The Hispanic Advertising Agencies Foundation (HAAF) will serve as an independent not-for-profit organization and will have a two-fold agenda. First it will aim to support, conduct, fund and distribute market research related to Hispanic consumers and advertising. Second it will strive to offer educational opportunities, materials and scholarships to those seeking to pursue a career in Hispanic advertising.

Comcast sued for disclosing Comcast sued for disclosing

customer info

Comcast is being sued by a Seattle-area woman for disclosing her name and contact information, court records showed on Thursday. In the suit, Dawnell Leadbetter said that she was contacted by a debt collection agency in January and told to pay a 4,500 for downloading copyright-protected music or face a lawsuit for hundreds of thousands of dollars. Leadbetter, a mother of two teens, was a customer of Comcast's high-speed Internet access service. The company, Settlement Support Center, based in Washington state, was using information that the RIAA had obtained in a Philadelphia lawsuit over the illegal sharing of digital music files, said Lory Lybeck, the lawyer representing Leadbetter. But no court authorized Comcast to release names and addresses of its customers, or notified his client that her information had been given to an outside party, Lybeck told Reuters. The RIAA has filed thousands of lawsuits since September and settled several hundred for about 3,000 each.

MMA launches Avista integrated marketing ROI service

Carat's Marketing Management Analytics, Inc. (MMA) announced the limited release of Avista by MMA Decision Support Service (Avista DSS), the first fully-integrated, enterprise managed service that gives companies the ability to make more profitable and informed marketing decisions throughout the marketing process. The limited release gives a select group of organizations a chance to preview the service and provide feedback prior to its public release in July. Advantages in using Avista DSS

CC radio raised rates in Q1 CC radio raised rates in Q1

CC Radio CEO John Hogan told Reuters last week that the company raised ad rates in Q1, although the company has indicated overall radio revenues suffered as it moved to cut down commercial airtime. "Advertisers are paying more for 60-second spots with us than they did last year, and more than they did the previous month," Hogan told Reuters, noting advertisers were also relying less on traditional 60 second spots and more on 30-second spots. But Hogan reiterated CC statements from February, signaling the new strategy slowed sales in the short-term, particularly as some advertisers moved to competitors. Analysts forecast Clear Channel's first quarter ad sales will be down 5.6%, compared with 3% to 5% projected increases among peers. "To reinvent the business, we knew there'd be short-term pain and competitors would not embrace it," Hogan said, but noted that Clear Channel was optimistic for the long-term. Hogan said their 1,200 stations are now running 40 percent fewer commercial minutes per hour and that listeners and advertisers have responded favorably.

|

|

|

|

|

May - Radio & Television Business Report

The First Real Monthly Business Media Magazine

|

|

Upfront looms on the horizon Upfront looms on the horizon

May Radio & Television Business Report focuses on One-On-One interviews with the money Ad Players: David Verklin, Steve Grubbs, Harry Keeshan, Jon Mandel, Ray Warren, Ira Berger, Jean Pool, Julie Roehm and others that read TVBR religiously. They're participating because they want you to know what they need to help make informed decisions. They comment on programming that they view promising for this upfront; they examine thoroughly the real issues that affect the marketplace as all are getting busy. This is a large story already and getting bigger.

Watch for the May Issue of

Radio & Television Business Report. The 2005-2006 Upfront Examined.

Advertising space in May is Sold Out. Reserve your Marketing space for the June issue... Advertising space is limited, contact:

June Barnes [email protected]

Jim Carnegie [email protected]

|

|

|

| Media Markets & MoneyTM |

Washington Beat, special southern edition

A Washington NC AM station is changing hands, according to broker Zoph Potts of Snowden Associates. Troy Dreyfus's Pirate Media Group is buying WDLX-AM from NextMedia Group Inc. for 400K. The 930 kHz News-Talker will join Pirate's WGHB-AM Farmville in a format-compatible duopoly - - the Farmville station is doing Talk-Sports, according to a BIA Geographic Market Definition report accompanying the transaction paperwork filed at the FCC.

RBR observation: These stations are part of the far-flung Greenville-New Bern-Jacksonville NC market - - they used to call it Coastal Carolina - - and stations which cover its full length and breadth are few and far between. As such, NM is running a supersized ten-station cluster (three AMs, seven FMs) courtesy of "grandfather." This grouping was perfectly legitimate under the old contour rules, but it's two over the limit under the new regime. It can stay together as long as NM owns it, but cannont be sold intact. BIA credits the market with 50 stations, meaning it supports an eight-station cluster with a five-station max in either service. So, is NextMedia selling off parts to enable a resale? Well, if they are, this won't help. The AM side of this cluster is perfectly legitimate under either set of rules - - to resell, two FMs would still have to go.

Close encounter in Oil City

Dick Kozacko of Kozacko Media Services tells us that William Hearst is now officially in place as the owner and operator of WKQW AM & FM Oil City PA. The 540K deal expands Hearst's Clarion County Broadcasting Corp., which already owned WWCH-AM/WCCR-FM in Clarion PA. The seller was Joseph V. Olszowka, acting as Executor of the Estate of Stephan M. Olszowka.

Gannett wants to invest in itself

Television/newspaper operator Gannett Co. has already spend "a substantial portion of the 500M authorized" for the purpose or reacquiring common stock. Now its board has told management to go out and get up to another 1B worth. Both open market and private block transactions will be considered. "At current prices, we believe Gannett's stock represents a very attractive investment opportunity."

|

|

|

|

| Washington Beat |

Martin cancels at NAB2005 Martin cancels at NAB2005

The one-on-one session between NAB President/Chairman Eddie Fritts and the new Chairman of the FCC Kevin Martin, has been called off. Martin withdrew, citing personal reasons. The reason is the recent death of his father.

Comstock unload

There is one less candidate to fill the open seat at the Commissioner level of the FCC, if a Reuters report is correct. Former aide to Sen. Ted Stevens (R-AK), currently working with a DC law firm, is said to have withdrawn his name from consideration. It appeared that the reason was personal. One of three Republican seats has been open since Michael Powell left, and the possibility of a second seat opening remains, as there has been nothing to reverse rampant speculation that Kathleen Abernathy is also headed out the door in the near future. Stay tuned.

|

|

|

|

| Programming |

Getting Sirius about Talk?

Can a man whose resume lists stints in the National Basketball Association, the US Senate and the Democratic presidential primary circuit make it in the world of audio Talk? Sirius Satellite Radio intends to find out. The satcaster has inked a deal for a weekly show with Bill Bradley. Bradley will host guests on the program as well as offer his own observations, opinions and stories.

RBR observation: If our memory of Bradley's speaking style still holds water, this could be the dullest addition to the Talk world since Mario Cuomo. This could put Sominex out of business.

|

|

|

|

| Ratings & Research |

Tribune hopes for better showing from LPM Tribune hopes for better showing from LPM

Blaming both general softness in TV ad demand and the impact of Nielsen's Local People Meters (LPM) for a 5% drop in Tribune's TV revenues in Q1, CEO Dennis FitzSimons told analysts that there's hope on the LPM front. "Next month Nielsen plans to initiate several initiatives to improve the effectiveness of the data gathering. Included is in-home coaching of sample participants, cash payments to encourage participation and reminder matters. These moves indicate that Nielsen recognizes that they need to improve their accuracy in measuring younger audiences," he said. As for Q2 pacings, FitzSimons said Q2 is looking a lot like Q1. "One bright spot - - we're beginning to see some political advertising in New York that should tighten the market and build somewhat through the year. We expect a hotly contested [NYC] mayoral election and the same with the New Jersey governor's race," he said.

|

|

|

|

| Engineering |

RAB releases white paper on HD Radio

The RAB recently developed a White Paper on HD Radio, which details where we are with HD Radio and where we’re heading. The White Paper also lists some of the revolutionary features HD Radio holds for consumers and advertisers.

Read the HDRadio White Paper.

|

|

|

|

| Monday Morning Makers & Shakers |

|

Transactions: 3/7/05-3/11/05

Dealmakers started getting back to work, with 14 deals involving 33 stations filed at the FCC, all on the radio side. The total was just a hair below 100M. To be fair, the total both in volume and value was somewhat inflated by a father-to-son stock deal involving nine stations and 35M, but it was still a healthy return to trading after three lackluster weeks.

|

|

Total

|

|

Total Deals

|

14

|

|

AMs

|

13

|

|

FMs

|

20

|

|

TVs

|

0

|

| Value |

96.575M

|

| Complete Charts |

|

Radio Transactions of the Week

Viacom sends a station to Camping

| More... |

|

TV Transactions of the Week

Not this week

|

|

|

|

|

| Transactions |

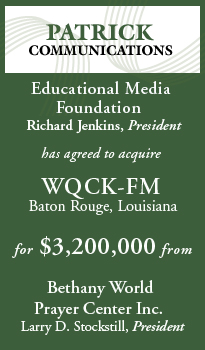

900K KPCO-AM/KBNF-FM Quincy-Chester CA (Quincy CA, Chester CA) from Carousel Broadcasting Inc. (Robert K. Fink) to Educational Media Foundation (Richard Jenkins). 45K escrow, 155K cash at closing, 70K note. Existing combo. [File date 3/18/05.]

265K WSEH-FM Cumberland KY from Cumberland City Broadcasting Inc. (Susan Burton) to JBL Broadcasting Inc. (Regina Kay Moore). 26.5K escrow, balance in cash at closing. Seller retains WCPM-AM Cumberland KY. [File date 3/18/05.]

|

|

|

|

| Stock Talk |

Gloom and doom over Wall Street

Stock prices were in a downhill slide for the last three days of last week. Friday's plunge came as IBM missed the target with its Q1 earnings report. That miss by Big Blue got investors' attention, despite strong earnings reports from GE and Citigroup. The Dow Industrials fell 191 points, or 1.9%, to 10,088 - - another year-to-date low.

The Radio Index also posted another YTD low, falling 4.226, or 2%, to 209.560. Beasley fell 4% and Univision dropped 3.6% as the worst performers.

|

|

|

|

| Radio Stocks |

Here's how stocks fared on Friday

| Company |

Symbol |

Close |

Change |

Company |

Symbol |

Close |

Change |

|

Arbitron

|

ARB

|

|

42.75

|

-0.43

|

Jeff-Pilot

|

JP

|

|

47.91

|

-0.54

|

|

Beasley

|

BBGI

|

|

15.60

|

-0.65

|

Journal Comm.

|

JRN

|

|

16.76

|

-0.15

|

| Citadel |

CDL |

|

13.30 |

-0.32 |

Radio One, Cl. A

|

ROIA

|

|

13.30

|

-0.40

|

|

Clear Channel

|

CCU

|

|

33.11

|

-0.70

|

Radio One, Cl. D

|

ROIAK

|

|

13.34

|

-0.40

|

|

Cox Radio

|

CXR

|

|

16.40

|

-0.38

|

Regent

|

RGCI

|

|

5.57

|

-0.03

|

|

Cumulus

|

CMLS

|

|

13.50

|

-0.17

|

Saga Commun.

|

SGA

|

|

15.19

|

-0.31

|

|

Disney

|

DIS

|

|

27.37

|

-0.26

|

Salem Comm.

|

SALM

|

|

19.46

|

-0.30

|

|

Emmis

|

EMMS

|

|

17.62

|

-0.48

|

Sirius Sat. Radio

|

SIRI

|

|

5.15

|

-0.15

|

| Entercom |

ETM

|

|

33.38

|

-0.52

|

Spanish Bcg.

|

SBSA

|

|

8.87

|

-0.26

|

|

Entravision

|

EVC

|

|

8.28

|

-0.19

|

Univision

|

UVN

|

|

26.32

|

-0.97

|

|

Fisher

|

FSCI

|

|

50.50

|

-0.41

|

Viacom, Cl. A

|

VIA

|

|

34.28

|

-0.55

|

|

Gaylord

|

GET

|

|

39.31

|

-1.32

|

Viacom, Cl. B

|

VIAb

|

|

34.12

|

-0.56

|

|

Hearst-Argyle

|

HTV

|

|

25.15

|

-0.22

|

Westwood One

|

WON

|

|

19.90

|

-0.10

|

|

Interep

|

IREP

|

|

0.56

|

-0.09

|

XM Sat. Radio

|

XMSR

|

|

27.50

|

-0.84

|

|

International Bcg.

|

IBCS

|

|

0.01

|

unch

|

-

|

-

|

- |

-

|

-

|

|

|

|

|

__UNSUB__ to this email service.

|

|

Bounceback

|

We want to We want to

hear from you.

This is your column, so send your comments to [email protected]

Jim,

Jeff is traveling today but asked me to get in touch with you regarding your "Observation" comments in Friday's TVBR and RBR, 04/15/05 TVBR #75 . It is unfortunate that you chose to chastise Emmis for not supporting Perry Sook. In fact, we were and are the ONLY broadcaster to publicly support him (see the quote he gave your Jack Messmer in January, below). Furthermore, Emmis has chosen to fight the good fight on the new frontier - digital. Emmis TV is firm in making absolutely no digital deals with cable unless we are paid - and, in fact, we do have one deal in which we are being paid. In other markets, include Portland, Ore., our digital signal is off because we have not been able to reach agreement with the local provider, although talks continue. While you took us to task, we are getting heat on a variety of fronts but standing firm. As to our analog deals - we are only signing short term agreements so that we can maintain our flexibility. We continue to monitor the situation. As always, I'm here, and Jeff is here, when you have questions, or would like clarification, on any issue that involves Emmis or the industry. Best, Kate Quote from Jeff in an email to Jack 1/18/05: I would hope every television broadcaster in America is willing to support Perry Sook and Nexstar in this important fight. There is nothing more important than broadcasters understanding that we must change this landscape

Kate Snedeker

Director, Media & Investor Relations

Emmis Communications

Publisher note: Kate: Jeff mentioned it in his conference and we felt it necessary to mention Sook is standing alone by doing not just talking. As the observations first stated - with no disrespect and none was intended. But Perry Sook is truly fighting the battle for all independents. Recommendation, Jeff may want to talk with Perry as RBR & TVBR also made the commitment to stand right next to Sook in his battle. The observation was a focus on how valuable the local content and HDTV etc is to the cable MSO's. Re-read the full observation on this topic.

|

|

|

NAB Daytime Planner

|

The following brokers will be attending the NAB. Call or email to make your appointment in advance.

Todd Fowler/David Reeder

American Media Services-

Brokerage, LLC

843-972-2200/903-640-5857

Bellagio,

americanmediaservices.com

Cliff Gardiner, Clifton Gardiner & Company, 303-758-6900,

Bellagio,

[email protected]

Andy McClure/Dean LeGras,

The Exline Company, Bellagio,

Office 415-479-3484

Frank Boyle,

Frank Boyle & Co., LLC,

Venetian Hotel,

203-969-2020,

[email protected]

John L. Pierce, John Pierce & Company LLC,

Mirage Hotel,

859-647-0101, cell 859-512-3015, [email protected]

Jamie Rasnick, John Pierce & Company LLC,

Mirage Hotel,

859-647-0101, cell 513-252-1186, [email protected]

Dick Kozacko/George Kimble,

Kozacko Media Services,

Bellagio,

office 607-733-7138, cell 607-738-1219, [email protected]

Bob W. Mahlman/Bob O. Mahlman, The 2 Bobs, Mahlman Co.,

914-793-1577, Hilton

Broadcast Foundation Hole in One Golf Tournament Sponsor.

Chuck Lontine,

Marconi Media Ventures, Inc.,

303-382-1000, cell 720-341-4722, [email protected]

www.marconi.cc

Elliot Evers, Media Venture Partners, LLC, 415-391-4877,

[email protected]

Larry Patrick/Greg Guy,

Patrick Communications,

Bellagio, 410-740-0250, [email protected]

|

|

|

International

|

PPM heading

to Norway

TNS, which licenses Arbitron's Portable People Meter (PPM) for Europe, Asia-Pacific, the Middle East and Africa, has announced a letter of intent to use PPM for radio audience measurement in Norway. The initial PPM panel will consist of 200 people, which may be expanded to 400 in 2006. Norway has a population of approximately 4.5 million. TNS's letter of intent is with the Norwegian national Radio's Steering Committee, which represents NRK, P4, Kanal 24, Radio 1, Nordic Web Radio and the Association of Local Radio Companies.

|

|

|

RBR Radar 2005

|

|

Radio News you won't read any where else. RBR--First, Accurate, and Independently Owned.

|

Looking ahead at Emmis

New buzz - death by a thousand cuts

Looking ahead, Smulyan expects the radio side will outpace the TV side. He used the phrase "death by a thousand cuts," but noted that it is overcoming numerous setbacks large and small. The TV side will have the age old problem of! overcoming the loss of political revenue in an off-election year. the TV division is paying close attention to the battle between cable and broadcast primarily being waged by Perry Sook. "We cannot continue to be the only people in American TV that do not get paid for our product," Emmis is taking a go-slow approach to HD radio. RBR observation: Jeff, Emmis staff and with no disrespect - just watching what Perry Sook does is not fighting the fight with him. Don't just talk about it stand tall with Nexstar, Sook and do as they did - pull the programming content, your most valuable resource and asset is your local content which the cable MSO's want because they can't produce local. Plus the MSO's also want the HDTV and not pay you a dime. If you haven't spent time pow-wowing with Sook, do so. Don't talk - do it. 04/15/05 RBR #75

DVR ad skipping losses to hit 27 billion over five years

Skipping and on demand viewing could cost the TV industry 27 billion in lost ad revenue over the next five years, according to new research released by Accenture. The consultancy reports that 70% of ads are already being skipped by viewers with digital video recorders; that trend will only get worse as DVR penetration grows from the current 8% of homes with DVRs to a projected 40% by 2009.

RBR observation: Which brings us to the point we continue to press - Content is King and Presentation Queen with more product placement on the way as ad clients way ROI. National TV Spot - get with EDI or lose it. Radio is doing a better job with EDI than TV - Period.

04/15/05 RBR #75

Making the case for a government thumb on Nielsen

As Nielsen Media Research prepares to roll out its Local People Meters (LPM) to two more markets - - Philadelphia and Washington, DC - - the Don't Count Us Out Coalition, which claims that LPMs undercount minority viewers, is ready with another round of anti-LPM advertising. Although Nielsen has indicated that it is receptive to instituting most of the recommendations from a Task Force chaired by former Rep. Cardiss Collins, coalition members say that not enough - - that the federal government must get into oversight of Nielsen to ensure fair and accurate audience estimates.

RBR observation: We stand by our view that getting the government involved would make matters worse, not better. Don't Count Us Out certainly has Sen. Conrad Burns (R-MT) on its side and he's planning to introduce legislation to push the government into regulating broadcast ratings. And News Corporation is certainly pushing the idea, since it is known to be providing most of the funding for the coalition. But is there any groundswell of support from broadcasters to have the government regulate their ratings currency? We asked the coalition folks whether they could name a single broadcast company other than News Corp. which is backing the idea. They couldn't name one, although they noted that several other broadcasters had voiced public concerns about LPM. True, but they're working within the industry to fix problems with LPM and deal with other issues about how Nielsen measures TV viewing. We stand by our view that getting the government involved would make matters worse, not better. 04/14/05 RBR #74

Telecom overhaul in the works

Sen. Ted Stevens (R-AK), head of the Senate Commerce Committee, said some time back that it was time to take a fresh look at the Telecommunications Act, which bears the almost quaint suffix of 1996, a reference to the year of its enactment. His sentiments have been echoed by his counterpart in the House, Rep. Joe Barton (R-TX). Telecom 1996 covered an extremely wide range of issues.

RBR observation: To say that the new rules ushered in by Telecom 1996 were dramatic would be a gross understatement. We were watching at the time, and can say that nobody - - and we mean nobody - - was predicting that local radio clusters of up to eight stations was coming, and that the national radio station ownership ceiling was going bye-bye in its entirety. Broadcast television has been waiting for its turn for deregulation ever since - - that was the major thrust of the stalled FCC ownership action of 6/2/03. Perhaps legislators will exercise an element of caution this time around - - we've heard time and time again, from people of all ideological stripes, that the dramatic and unprecedented growth of Clear Channel was an unintended consequence of the 1996 Act. Will they be more on the lookout for new unintended consequences? All we can say is that it's time to strap in, folks. 04/14/05 RBR #74

|

|

|

|

|

When you need to find the executive to help you grow in any position within your media organization - Then come to where over 35,000 executives read first their 7:30am morning E-paper and then 4:30pm afternoon media news and information:

RBR - TVBR - Media Mix

Media HeadHunters

Delivering results.

For Confidential Placement Contact: Cathy Carnegie, VP, [email protected]

|

|

|

|

|

|

Help Desk

|

Having problems

with our epapers?

Please send Questions/Concerns to:

[email protected]

|

|

|

|

©2005 Radio Business Report/Television Business Report, Inc. All rights reserved.

Radio Business Report -- 2050 Old Bridge Road, Suite B-01, Lake Ridge, VA 22192 -- Phone: 703-492-8191

|

|