Click on the banner to learn more...

|

U.S. ad spend rose 2.4% Q1

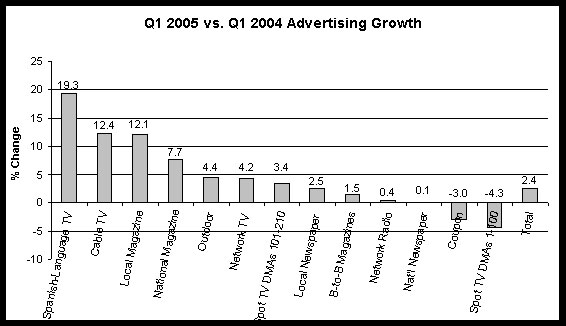

Advertising spending for Q1 rose 2.4% over the same period last year, due to gains across major media, according to preliminary figures released today by Nielsen Monitor-Plus.

Advertising spending increased in almost all reported media, led by Spanish-Language TV, Cable TV, and Magazines. Network Radio and National Newspaper were essentially flat, while Coupon and the top 100 Spot TV markets showed declines. "Taking a closer look at Spot TV's performance for the quarter, the medium was down 3.9% overall; however, the smaller 101-210 DMAs experienced a steady 3.4% growth", said Jeff King, managing director of Nielsen Monitor-Plus.

Q1 ad spend for the top 10 companies reached 4.8 billion, up 8.1% from last year. Nearly every advertiser experienced growth. As usual, the automotive companies show healthy gains, accounting for 2.3 billion in spending, nearly half of the top 10 total.

Spending for the 10 largest categories reached 9.9 billion in the first quarter, 3.9% greater than the same period last year. The Credit Card Services category, which continues to be the fastest growing in terms of% increase (30.5%), continues to increase ad spending, exceeding 404 million dollars. Prescriptions Drugs, typically a category that shows substantial growth, has cut back spending 29 million (-2.8%).

Nielsen's Product Placement tracking service shows significant growth in the integration of product occurrences in primetime broadcast network programming. The top 10 brands in the product placement category totaled 6,020 occurrences during Q1.

Says King: "Illustrating just how quickly product placement is growing, the number one brand, Coca-Cola Classic, had 1,931 brand occurrences for the quarter, compared to 2,320 for all of last year." Coca-Cola Classic was also the number one brand for 2004. Coca-Cola Classic had nearly three times the number of occurrences than the number two brand, Everlast Apparel (691 occurrences). This is in part due to the brand's relationship with American Idol.

The top 10 programs that featured product placements in Q1 accounted for 12,867 occurrences. Further pointing to the rapid growth of this medium, this one quarter's occurrences (12,867) is more than half the brand occurrences for the Top 10 Programs in FY 2004 (23,526).

Top 10 Advertisers

|

January – March 2005

|

|

|

Q1 2005 ($ Mil)

|

% Change

|

|

General Motors Corp.

|

$812

|

5.8%

|

|

Procter & Gamble Co.

|

$677

|

-8.2%

|

|

Ford Motor Co.

|

$624

|

23.2%

|

|

Toyota Motor Corp.

|

$442

|

14.5%

|

|

DaimlerChrysler AG

|

$430

|

0.6%

|

|

Time Warner Inc.

|

$424

|

16.0%

|

|

Johnson & Johnson

|

$400

|

21.4%

|

|

Walt Disney Co.

|

$392

|

-3.5%

|

|

Altria Group

|

$351

|

38.2%

|

|

SBC Communications

|

$295

|

-3.6%

|

|

Total

|

$4,846

|

8.1%

|

|

Source: Nielsen Monitor-Plus

Note: Automotive Advertisers reflects Factory and Dealer Association spending

Based on spending estimates in the following media: Network TV, Spot TV, Syndicated TV, Hispanic TV, Nat’l/Local Magazine, Network/Spot Radio, Outdoor, FSI (CPGs only), Nat’l/Local Newspapers (display ads only), Nat’l/Local Sunday Supplements

|

|

Top 10 Product Categories

|

January – March 2005

|

|

|

Q1 2005

($ Mil)

|

Q1 ‘04 vs.

Q1 ‘05

$ Change

|

Q1 ‘04 vs.

Q1 ‘05

$%Change

|

|

Automotive: Factory & Dealer Assoc.

|

$3,185

|

$124

|

4.1

|

|

Automotive Dealerships-Local

|

$1,239

|

$2

|

0.1

|

|

Prescription Drugs

|

$985

|

-$29

|

-2.8

|

|

Restaurants-Quick Service

|

$931

|

$101

|

12.2

|

|

Motion Picture

|

$814

|

-$102

|

-11.2

|

|

Department Stores

|

$737

|

-$6

|

-0.7

|

|

Telephone Services-Wireless

|

$692

|

$104

|

17.7

|

|

Direct Response Products

|

$543

|

$45

|

8.9

|

|

Credit Card Services

|

$404

|

$94

|

30.5

|

|

Restaurants

|

$368

|

$35

|

10.6

|

|

Total

|

$9,897

|

$369

|

3.9

|

|

Source: Nielsen Monitor-Plus

Based on spending estimates in the following media: Network TV, Spot TV, Syndicated TV, Hispanic TV, Nat’l/Local Magazine, Network/Spot Radio, Outdoor, FSI (CPGs only), Nat’l/Local Newspapers (display ads only), Nat’l/Local Sunday Supplements

|

|

|

Top 10 Brands: Product Placement

Q1 2005

|

|

Brand

|

Total # Occurrences

|

|

Coca-Cola Classic Reg. Soft Drink

|

1,931

|

|

Everlast Apparel

|

691

|

|

Everlast Sporting Equipment

|

634

|

|

Adidas Apparel

|

476

|

|

Sports Illustrated Magazine

|

475

|

|

Nike Apparel

|

466

|

|

Gatorade Drinks-Isotonic

|

441

|

|

Home Depot Store

|

324

|

|

Toyota Autos & Trucks

|

319

|

|

New York Yankees Baseball Team

|

263

|

|

Total

|

6,020

|

|

Source: Place*Views, Nielsen Product Placement service

|

|

Top 10 Programs: Product Placement

Q1 2005

|

|

Program

|

Network

|

Total # Occurrences

|

|

The Contender

|

NBC

|

2,828

|

|

American Idol

|

FOX

|

2,373

|

|

The Road To Stardom With Missy Elliott

|

UPN

|

1,650

|

|

Amazing Race

|

CBS

|

1,140

|

|

The Apprentice

|

NBC

|

978

|

|

Extreme Makeover Home Edition

|

ABC

|

916

|

|

Sports Illustrated Swimsuit Model Search

|

NBC

|

792

|

|

What I Like About You

|

WB

|

783

|

|

King Of Queens

|

CBS

|

747

|

|

Fear Factor

|

NBC

|

660

|

|

Total

|

|

12,867

|

|

Source: Place*Views, Nielsen Product Placement service

|

|

|

|

Radio Business Report

First... Fast... Factual and Independently Owned

|

|

New readers can receive our RBR Morning Epaper

FREE for the next 60 Business days!

|

|

|

©2005 Radio Business Report/Television Business Report, Inc. All rights reserved.

Radio Business Report -- 2050 Old Bridge Road, Suite B-01, Lake Ridge, VA 22192 -- Phone: 703-492-8191

|