Among those who have digital antennas in use to provide broadcast television signals to their home, priority placement is being given to it — perhaps filling space once occupied by a set-top box leased from a cable TV service provider.

There’s more: Streaming accounts for a little over half of their viewing time spent, illustrating just how much consumption of free-to-air broadcast television is seen by those who have a digital antenna.

The findings are tied to Horowitz’s latest State of OTA 2022 report, which tracks the evolving market for over-the-air (OTA) antennas, wireless 5G home internet services, and other disruptive technologies. The study looks at the role digital antennas play in keeping consumers connected to live, linear broadcast content as Americans continue to shed traditional cable or satellite (MVPD) services.

This year, 18% of TV content viewers report having a digital antenna. This is consistent with 2021, though lower than penetration during COVID, during which antenna adoption and usage spiked.

But, the study finds that digital antenna ownership has grown significantly among younger viewers — from 14% in 2021 to 23% in 2022. In fact, younger viewers now over-index on digital antenna usage compared to their older (50+) counterparts (23% and 15%, respectively).

Horowitz also finds that Hispanic viewers over-index on digital antenna ownership compared to all other segments (25%, compared to 18% among white non-Hispanic and Black viewers, and 19% among Asian TV content viewers).

Meanwhile, Horowitz’s study concludes that 67% of digital antenna owners have an antenna on the TV that is used the most in the home — a number that rises to 78% among digital antenna owners who do not have MVPD service.

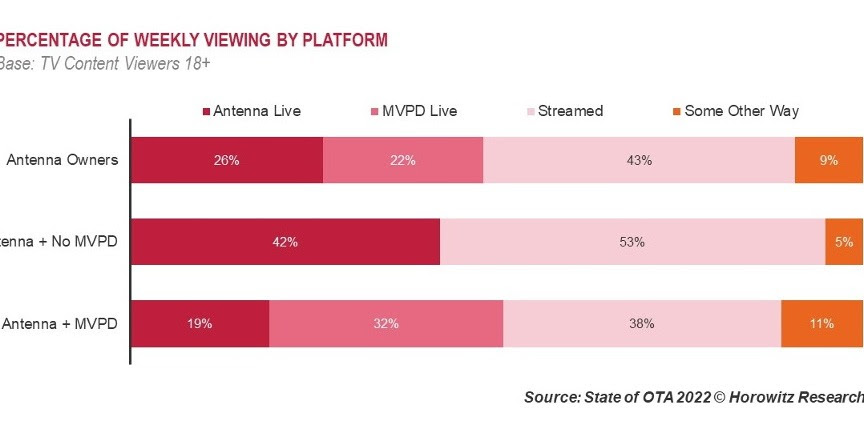

Perhaps the biggest takeaway for broadcast television is that those with antennas are using it. Self-reported time spent with content delivered through a digital antenna accounts for about 1 in every 4 viewing hours among antenna owners overall, growing to over 4 in 10 hours of viewing time spent among antenna owners without MVPD service (42%). Streaming accounts for a little over half of their viewing time spent, as illustrated in the chart below.

Being able to get live access to local broadcast channels is the main reason for getting an antenna, followed by being able to access local news.

Notably, hyper-local content is also critical to antenna owners, with 58% saying they are interested in hyper-local news and information from their specific community. Indeed, interest in hyper-local content is on par with interest in national and regional news.

While 62% of owners are satisfied with their digital antennas, reliability and the number of channels available are frustration points for some consumers. Given the desire to remain connected to live, local and hyper-local content, there is a missed opportunity to better market the technology to non-adopters, Horowitz concludes. Some 54% of non-antenna owners say they know only a little about digital antennas. When presented with a description of the technology and its benefits, almost in in every 10 non-antenna owners say they would be interested in getting a digital antenna. Overall, the study finds that 13% of TV content viewers are either planning to get a digital antenna or would be very likely to adopt an antenna in the near future based on the description provided in the survey.