Adjusting to change is essential when facing relentless competition compounded by ongoing disruption and slow growth.

Citing data and analysis, PwC’s 2017 Global Entertainment and Media Outlook offers compelling insights into how media and consumer-focused entertainment companies are adapting, investing, experimenting and innovating amid six areas of change.

We’ve got details for all RBR+TVBR members.

In a 44-page report, “Perspectives from the Global Entertainment and Media Outlook, 2017–2021,” Deborah Bothun, PwC’s Global Entertainment & Media Leader, and Brad Silver, PwC’s Global Technology, Media, and Telecommunications Leader, note that, while it is “a cliché” to note that something fundamental has changed in the global entertainment and media (E&M) industry, the reality is that something significant has changed.

“E&M companies have been accustomed to competing and creating differentiation primarily based on two dimensions: content and distribution,” they say. “Now they must focus more intensely on a third: user experience.”

They continue, “To thrive in a marketplace that is increasingly competitive, slower-growing, and dependent on personal recommendations, companies must develop strategies that engage, grow, and monetize their most valuable customers — i.e., their fans. To do so, they must combine excellent content with breadth and depth of distribution, and then bring it all together in an innovative user experience, in which the content is discoverable easily on an array of screens and at an attractive price. Simply capturing the natural growth in consumers and their uptake of services and content with existing approaches is no longer sufficient.”

Across the industry, the resulting quest to create the most compelling, engaging, and intuitive user experiences is now the primary objective for growth and investment strategies — and technology and data lie at their center.

They say, “Pursuing these strategies will help companies thrive in an era of complexity and slowing top-line growth from the traditional revenue streams that have nourished the E&M industry to date.”

A NEW FOCUS ON THE USER

In the report, Bothun and Silver note, “Rapid changes in technology, user behavior, and business models … have created a gap between how consumers want to experience and pay for entertainment and media and how companies produce and distribute their offerings.”

To bridge this gap, companies should pursue two related strategies:

- Focus their efforts on building businesses and brands anchored by active, higher-value communities of fans, who are united by shared passions, values, and interests

- Capitalize on those emerging technologies that delight users in new ways, deliver superior user experiences, and enhance productivity

Another tip Bothun and Silver offer is for a business to become more “fan-centric.” They note, “Business that are fan-centric will find themselves with audiences that are more engaged, are more committed, and spend more per capita. Today’s fans will also recruit tomorrow’s. And, companies that ‘super-serve’ fans via new and deeper experiences will move faster to unlock opportunities for revenue expansion.”

Here’s a good takeaway for the media company C-Suite: Embracing a fan-centric approach requires making transformational changes throughout the enterprise.

To accomplish this, a radio or TV company executive should focus on the following four things:

- Know who the fans are

- Increase business agility and flexibility

- Monetize the total fan relationship

- Adopt a user-/fan-centric focus

But, has “traditional media” including TV and radio reached a plateau?

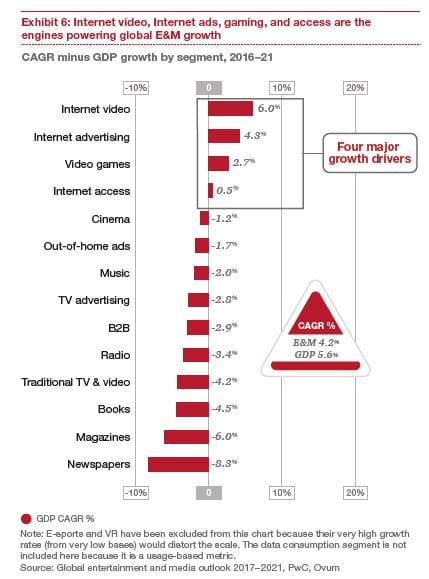

Bothun and Silver state, “Over the next five years, most E&M segments will struggle to keep pace with GDP growth. Only two segments, newspapers and magazines, are declining in absolute terms. But, other major segments, including TV advertising, B2B content, and cinema, will shrink as a share of the global economy between now and 2021. The areas that are showing growth, such as internet video and internet advertising, are not sufficiently large to overcome the stagnation in other areas.”

To download the report in full, please click here: pwc20170711