On Monday, RBR+TVBR readers shared with readers the news that Sovryn Holdings, a licensee created to acquire low-power television stations and led by Philip Falcone, had not emerged as the buyer of a Lotus Communications property in Phoenix. RBR+TVBR‘s headline referred to the non-consummation of a July 2021 transaction agreed to by each party as a “flop.”

Falcone took umbrage at the description of the deal’s dissolution, and tells RBR+TVBR it is all part of a bigger plan for Sovryn in the Valley of the Sun.

With Patrick Communications serving as the seller’s broker of record, Sovryn signed off on a $2 million asset purchase agreement for KPHE-LD 44, licensed to Phoenix. The station includes five subchannels and has a transmitter atop Phoenix’s famed South Mountain.

It was the latest in a string of acquisitions by Sovryn seen across 2021, which include a $5.4 million purchase of CGTN America-affiliated WXNY-LD 32 in New York; $1.05 million transaction poised to give it KDTL-LD 16 in St. Louis; a $5.25 million deal with Prism Broadcasting Network for WANN-CD 20 in Atlanta; a $1.5 million purchase of KVSD-LD in San Diego; and LPTV Construction Permits being sold by Mako Communications.

With the February 24, 2022, submission by Lotus of a non-consummation notice, it seemed clear that Sovryn was unable to move forward with the deal. Sources close to the matter expressed frustration about the transaction’s dissolution. Another source tells RBR+TVBR the Phoenix non-consummation notice is the second one to involve a change of heart at Sovryn.

On Friday (3/18), Falcone assailed RBR+TVBR for its use of the word “flop” in the March 14 headline, suggesting that, rather than a flip-flop on a decision to purchase KPHE, he had been financially been unable to compete the deal.

“I didn’t ‘flop,'” he said, “It was my choice not to close.”

Why? “We are doing something different, and we are buying other stations [in Phoenix],” Falcone said.

Asked to elaborate on the plan, Falcone declined to offer specifics at this time. But, when pressed to offer details, he replied, “We’re going in a completely different direction.” A filing of an Asset Purchase Agreement for two different Phoenix-market properties is expected to occur in the coming weeks.

Falcone made it clear, however, that Sovryn “didn’t need that station,” referencing KPHE.

As such, Lotus, under the direction of First Vice President Jim Kalmenson, has instead agreed to sell KPHE to Gray Television at a $250,000 haircut.

Falcone also shared a glimpse of his vision at Sovryn Holdings, noting that he’s up to “something completely unique and different,” hence his decision not to complete the KPHE deal.

Falcone launched Sovryn following the end of a rocky tenure as the head of HC2 Holdings. His June 2020 departure came under a cloud of negative headlines across New York’s news organizations. There were accusations that Falcone defaulted on loans. His assets were frozen for failure to compensate his legal representatives. This followed a 2019 court order that saw HC2 withhold some of Falcone’s salary in lieu of some $2.69 million in unpaid taxes to the City of New York.

The bad press hasn’t ceased for Falcone, with the New York Post earlier this month detailing — in a decisively negative tone — his decision to sell the furnishings of his posh Lenox Hill townhouse on Manhattan’s East Side. The 7-bedroom, 12-bath residence with 13,300 square feet, one block east of Central Park, is presently listed for $27.5 million. This follows articles in Financial Times, The Wall Street Journal and The Real Deal that have been less than flattering.

In December 2021, WSJ reporter Rachel Louise Ensign wrote, “Philip Falcone was worth more than $2 billion a decade ago. By last year, he was representing himself in court, saying he couldn’t afford a lawyer. ‘I’m behind on virtually every one of my bills,’ Mr. Falcone said at a court hearing in a lawsuit filed by one of his many creditors. ‘Including my kids’ tuition.’” She also reported that the IRS seeks $7.7 million from Falcone.

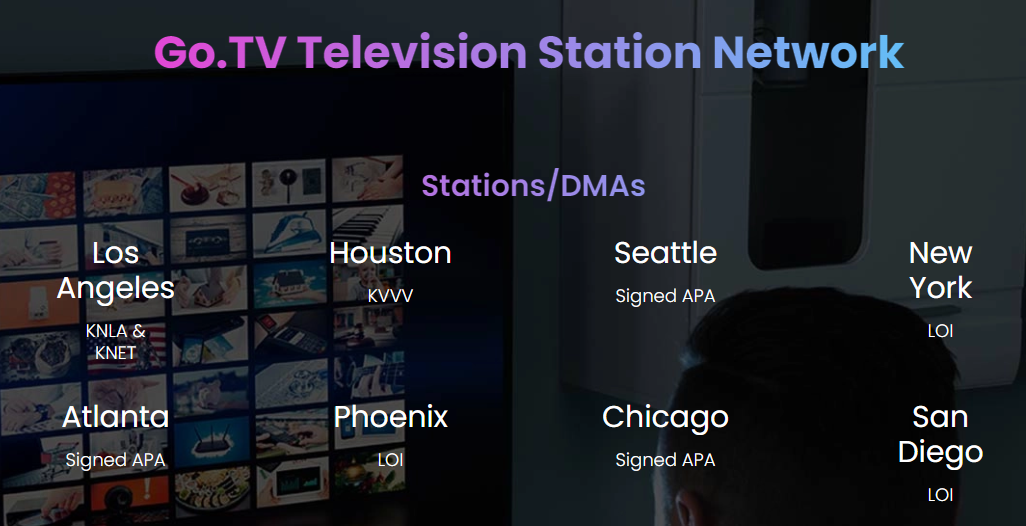

Despite all of the noise from the press, Falcone appears to be squarely and confidently focused on moving forward with Sovryn Holdings’ master plan — one that involves a free-to-air launch of a platform tied to GO.tv.

“Go.TV is the new Generation of Broadcast Television – for everyone, everywhere,” it claims.

GO.tv’s biggest selling point?

Turn your iPhone and iPad into a Mobile TV antenna.

The company explains, “Go.TV’s proprietary hardware will enable iPhone and iPad devices with OTA viewing capability – allowing access to not only Go.TV’s broadcast programming but all broadcast stations (NBC, ABC, CBS, Fox, etc. ) free! No data charge, no cable charge… Devices are coming soon!”

A Phoenix station is listed on GO.tv’s website.

GO.tv’s leadership includes COO and Chief Technology Officer Henry Turner, Broadcast Management executive Dennis Davis, marketing pro Warren Zenna and Controller Cathy Viola.

GO.tv is a subsidiary of Madison Technologies Inc., which trades on the OTC as “MDEX.” It is currently priced at $0.1949 per share.

How GO.tv goes is Falcone’s primary focus as Sovryn seeks to grow, with a vision that is coming to fruition under an acquisition plan that’s clearly in evolution. And, it comes with the full confidence of an individual intent on moving forward with new personal and professional success.