When subtracting bobsleds and curling, the second month of 2018 was darling for advertising.

Excluding the Winter Olympic Games from South Korea, the total U.S. national ad market grew by 8% in February 2018, compared to last year.

This was driven by “strong gains” in National Television, Digital, and Radio, according to the latest data from Standard Media Index.

SMI released its February 2018 ad market data on Monday (3/26), and in the month year-over-year advertising revenue in National TV grew 12%, with an even 12% growth in Cable and 12% growth in Broadcast.

That’s primarily thanks to “big ticket” events such as the Winter Olympic Games, the Academy Awards and the Grammy Awards, SMI notes.

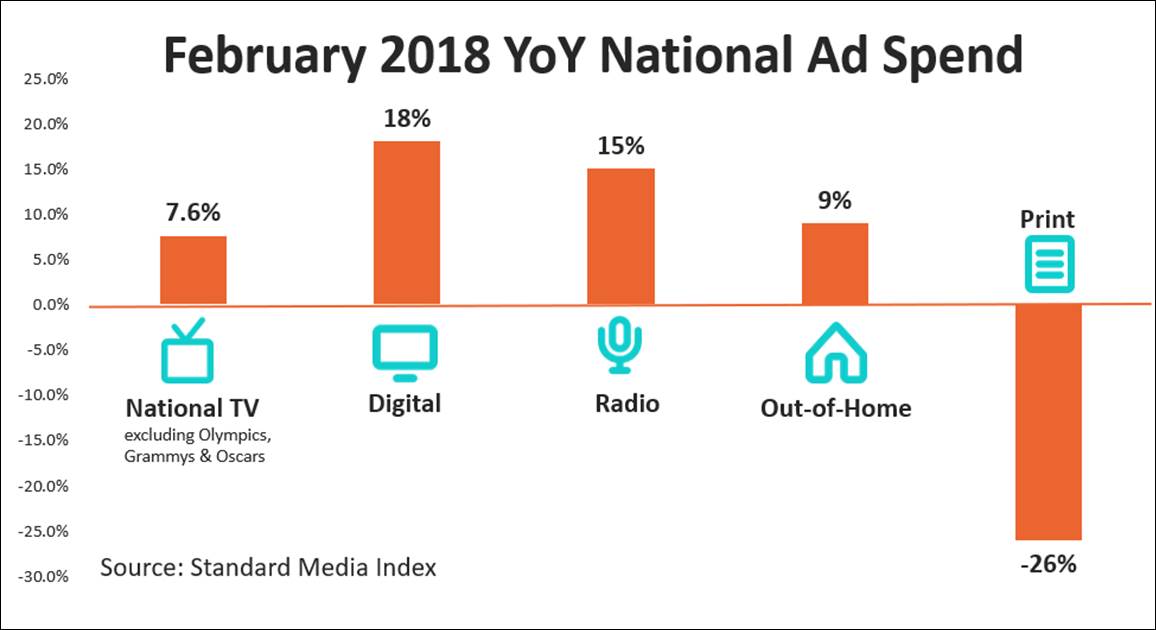

By taking out the Olympics, Oscars, and Grammys, the underlying year-over-year growth in February for National TV is 7.6%.

To little surprise, Digital experienced significant growth, growing 18% in the month compared to February 2017.

But guess what media grew at a faster rate than TV?

Radio’s national ad spend increased by 15%.

The growth seen by National TV (excluding big events such as the Olympics, Grammy Awards and Academy Awards), Digital and Radio outpaced that of the out-of-home category. OOH grew by 9%.

Also to little surprise is the continued disintegration of U.S. Print media. In February 2018 year-over-year national ad spending for Print slid by 26%.

“February was a terrific month for National TV, even putting the success of Olympics to the side,” notes SMI CEO James Fennessy. “The underlying jump of 7.6% was all down to the power of live sports as the major broadcasters had big year-over-year falls in entertainment as they didn’t want to compete with NBC’s Olympics coverage.”

GOODWILL GAMES: DOLLARS SPREAD BEYOND SOUTH KOREA

Meanwhile, SMI saw ESPN’s revenue jump “significantly,” thanks to big increases in the NBA, College Basketball and its signature Sports Center studio shows. FS1 was no slouch, either, and also saw big gains in NASCAR and College Basketball.

To top it off, NBC’s telecast of Super Bowl LII “slammed on $20 million more than last year’s event,” Fennessy says.

Super Bowl LII generated in-game television revenue of $337 million, which was 3.4% higher than the game last year. Incorporating both linear TV and Digital, ad revenue for all Super Bowl programming was more than $400 million.

Meanwhile, the special airing of NBC drama This Is Us after the big game generated more than $12 million dollars in television revenue — the highest amount that a single episode of the show has ever earned.

Altogether, NBC earned more than $450 million for all TV programming and digital placements taking place on Super Bowl Sunday.

“The ability of live Sports to attract national advertisers was further reinforced with the great results NBC delivered in Super Bowl LII,” Fennessy notes. “While ratings fell 7%, revenue was up significantly and an average 30-second spot rose 3.8%. The move to run This Is Us following the Super Bowl was a masterstroke that achieved an extraordinary unit rate of almost $900,000 for a 30-second spot, which is more than double its already stellar rate.”