RBR+TVBR INFOCUS

On Wednesday (8/14), U.S. financial markets took a tumble. This was the result of the emergence of an inverted yield curve. Translation: There’s less confidence in the short-term financial outlook than the long-term forecast.

A host of media companies were swept up in the big selloff, but not iHeartMedia, which revealed its first post-bankruptcy Q2 earnings report on Thursday.

Perhaps that is a good sign for the company led by Chairman/CEO Bob Pittman. He said during iHeart’s Q2 earnings call, in response to an analyst inquiry, that a recession — while not asking for one — would be beneficial for radio.

Asked about the potential downturn in the U.S. economy and how that could possibly impact iHeartMedia, Pittman was frank.

“Our biggest issue is getting advertisers to try radio, to give it a shot, and when times are good and business is good, they do the same things,” he said, referring to some that are reluctant to include the medium in their marketing mix. “In a downturn, given the price of radio and its efficiency and superior ROI, we may find people to try some media mix changes, like P&G did.”

Thus, a recession could bring more revenue, not less revenue, to a radio company because of its overall value against other media.

That said, Pittman explained that marketers looking for leaner, efficient ways to reach consumers during the economic downturn of 2008 and 2009 turned to digital and social media. Speaking of the spooked financial markets and warning sign of a recession, Pittman reiterated, “I don’t think people are looking for it, but there are opportunities.”

The query came during a vibrant Q&A session led by a veteran media industry analyst who hasn’t been heard from in ages: Jessica Reif Ehrlich (formerly Cohen), today a recently remarried Managing Director covering media and entertainment for Bank of America Merrill Lynch.

Ehrlich, along with Wolfe Research analyst Marci Ryvicker (who concluded the questions on the iHeart Q2 2019 call), were once among the most omnipresent Wall Streeters participating in broadcast media conference calls across the first half of the 2000s.

Ehrich noted that the markets are focused on recession, and asked Pittman and CFO/COO Rich Bressler what specifically in the iHeart business model would protect the business from a potential downturn.

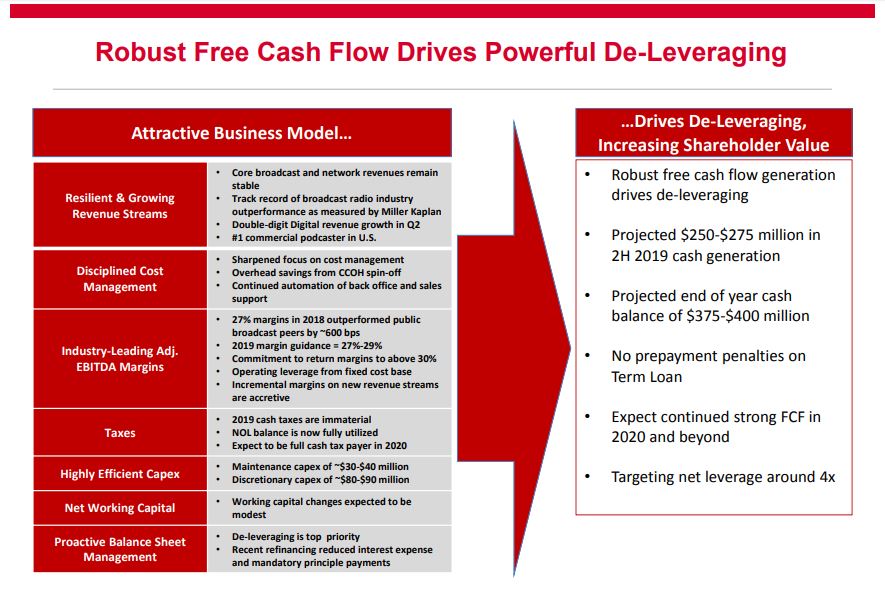

He pointed to Page 11 in a 23-page investor deck.

Bressler noted that iHeart has the ability, with a $110 million capital expenditure, to deliver on that. In particular, he remarked that iHeart’s margin expansion has been good at times when there has been no significant revenue growth.

But, as the graphic shows, returning EBITDA margins to above 30% is a priority — and something iHeart sees as an industry leader, surpassing companies such as Entercom, Beasley Media Group and Saga Communications — all of which are struggling on Wall Street of late.

A “sharpened focus on cost management” is a big part of the iHeart success plan, as is the introduction of blockchain for back-office functions — resulting in less staff but greater efficiencies.

Of course, de-leveraging is Priority One for the “new” iHeart, and “robust” Free Cash Flow will fuel further debt reduction. The goal: net leverage of around 4x.

Commenting on overhead savings and more automated back-office tasks, Pittman said that iHeart has the technology to provide efficiency, because it does reduce cost in addition to adding reliability. “On the programming front, even the use of technology to assist and improve the decision-making speeds things up.”

BANKRUPTCY: GOOD PREP FOR U.S. ECONOMIC WOES

Analyst Stephen Cahill had a question for Pittman.

Having run the company through its Chapter 11 bankruptcy protection, what can he — and iHeartMedia — do now that he has “the shackles off,” which can make his job easier?

Like President Trump, Pittman took aim at the media.

“The worst thing was just the negative press,” Pittman said of iHeart’s time as a debtor-in-possession. “It effects employees, clients and partners. Getting rid of that cloud is just great for us.”

With excitement for a future “that doesn’t have the blemishes or worries on it,” Bressler and Pittman are prepared to tighten the sails and navigate whatever choppy waters emerge in the coming months for all U.S. businesses and consumers.

“If the economy hits headwinds — and Rich and I have run companies in tough times — nothing can prepare you to be scrappy than the period we just went through,” Pittman said. “Yet, we still managed to have 21 straight growth quarters.”