ZenithOptimedia predicts global ad spend will reach $503 billion by the end of the year. This is the same as the growth rate they forecast back in June, marking the first time ZO has not downgraded their 2013 forecast since June 2012. ZO expects stronger growth over the next two years – of 5.1% in 2014 and 5.9% in 2015 – mainly because Europe, which is currently acting as a brake on global ad growth, will become healthier over the next couple of years.

ZenithOptimedia predicts global ad spend will reach $503 billion by the end of the year. This is the same as the growth rate they forecast back in June, marking the first time ZO has not downgraded their 2013 forecast since June 2012. ZO expects stronger growth over the next two years – of 5.1% in 2014 and 5.9% in 2015 – mainly because Europe, which is currently acting as a brake on global ad growth, will become healthier over the next couple of years.

The Eurozone came out of its 18-month recession in Q2 2013, and its economic recovery is expected to gather pace gradually over the next couple of years. The Eurozone ad market should follow the same track. Eurozone adspend shrank 5.2% in 2012; we forecast a smaller 4.3% decline in 2013, followed by marginal 0.7% growth in 2014 and 1.9% growth in 2015.

Ad spend in North America is much more robust than in mature Europe. Consumer confidence, retail sales, job numbers and house construction are all trending encouragingly upwards. Ad spend grew a healthy 4.4% in 2012, thanks partly to the summer Olympics and the elections in the US. In their absence Zenith forecasts a slightly more subdued 3.4% growth in 2013, followed by firmer 4% to 5% annual growth in 2014 and 2015.

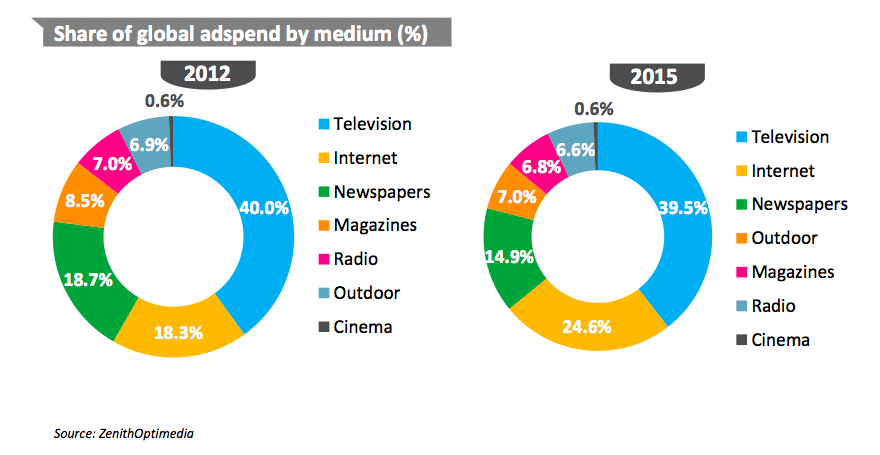

Not much was said about radio, but its share of global ad spend by medium is expected to drop from 7.0% in 2012 to 6.8% in 2015.

Television’s share of global ad spend has stabilized, after growing slowly but surely for most of the last three decades. Television accounted for 31% of spend in 1980, 32% in 1990, 36% in 2000 and 39% in 2010. ZO now expects television’s market share to peak in 2013 at 40.1%, before falling back marginally to 39.5% in 2015. However, overall video advertising is still on the rise – between them, television and online video attracted 41.2% of global ad spend in 2012, and they expect them to attract 41.6% in 2013.

ZO forecasts 8% growth in desktop ad spend in 2013 and 2014, and 7% in 2015. They expect total internet advertising – both desktop and mobile – to account for 20.4% of all ad expenditure in 2013, up from 18.3% in 2012, and forecast its share to rise to 24.6% in 2015.

Display is the fastest-growing sub-category, with 20% annual growth, thanks partly to the rapid rise of online video and social media advertising, which are growing at 25% and 33% a year respectively.

Zenith forecasts paid search to grow at an average rate of 15% a year to 2015, driven by continued innovation from the search engines, including the display of richer product information and images within ads, better localization of search results, and mobile ad enhancements like click-to-call and geo-targeting.

Mobile advertising is expected it to total $14.3 billion worldwide this year, or 2.8% of total ad spend. It is growing extremely rapidly: ZO forecast 77% growth in 2013, followed by 56% in 2014 and 48% in 2015. By 2015 they expect mobile ad spend to total $33.1 billion and account for 6.0% of total ad spend.

“The stability of global adspend growth this year – a year without big events like the Olympics and US elections – shows that the advertising recovery is on track, promising even stronger growth in 2014 and 2015. The increasing penetration of mobile handsets is playing a key role in driving advertising growth across the world,” said Steve King, ZenithOptimedia’s CEO, Worldwide.