|

|

|

|

|

Volume 24, Issue 36, Jim Carnegie, Editor & Publisher

|

Wednesday Morning February 21st, 2007

|

|

|

Radio News ®

|

What are the XM-Sirius odds? What are the XM-Sirius odds?

Sirius Satellite Radio CEO Mel Karmazin insisted in a joint Wall Street conference call with XM Chairman Gary Parsons that there is a "better than 50/50 chance" that regulators will allow the two companies to merge. Some Wall Street analysts say that is overly optimistic. Parsons was unwilling to assess the probability of success, but said his board of directors would not have entered into the merger agreement if they were not convinced that it was in the public interest. Karmazin was more emphatic: "I would not have gone to our board and have recommended it, nor would they have approved it, if they didn't believe that the chances were greater than 50/50." The financials make sense, says Goldman Sachs analyst Mark Wienkes, but that doesn't mean the deal will fly with regulators. "In our view, merging platforms could deliver significant operational, financial, and strategic benefits, likely exceeding four billion, though mostly years away. That said, we continue to believe that that the merger is unlikely to pass muster with the FCC, DOJ, and investors, assuming current terms. Finally, we caution that some investors might view the emergence of the merger proposal as a lack of confidence in the fundamental business outlook as stand-alone competitors," Wienkes said in a note to clients. Likewise, Bank of America analyst Jonathan Jacoby sees huge hurdles for the merger to clear. " Our contacts in D.C. maintain that procedural hurdles could stop a deal from getting through the FCC - we estimate the probability of obtaining regulatory approvals before end of Q1 2008 at less than 50%. As we have stated previously, the Achilles heel for sat radio could prove to be the existence of a rule that prohibits the two providers from merging. The FCC might not be able to simply waive this rule; it might have to formally change this rule. This could take time and the window to get approval before the '08 elections is narrow," Jacoby told clients. The BofA analyst thinks the NAB may try to short-circuit the merger attempt by having friendly Members of Congress tack on an amendment barring the FCC from allowing the only two satellite radio licensees to merge. A likely bill, he said, would be the pending "Local Emergency Radio Service Preservation Act of 2007" that would ensure that XM and Sirius don't use their terrestrial repeaters for local programming (2/14/07 RBR #31). Is the merger a long-shot? Wall Street traders gave it a thumbs up. XM shares opened yesterday with a gain of 15.2%, but that narrowed to 10.2% by the closing bell. Sirius opened up 8.7% and finished the day up 6%.

RBR observation: One analyst offered a simple solution during yesterday's conference call, but it nearly sent Karmazin and Parsons into cardiac arrest. Why not avoid the whole FCC issue by combining the businesses and their subscriber bases, and turn in one of the satellite spectrum licenses? Oh, no! The satellite radio bosses said they couldn't do that. They need all of the spectrum from both companies so they can continue to serve the non-compatible receivers that each has in the marketplace (somehow they never mention that they have been ignoring the FCC requirement that their receivers be compatible) and to add video, data and other new services to make them more competitive with other media.

|

|

|

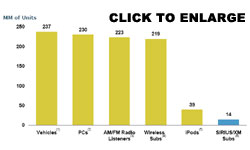

Making the case Making the case

for a merger

With Congress in recess this week, XM and Sirius execs will be heading to Capitol Hill next week to begin making the case to support their planned merger. This chart will likely play a key role. "In today's expanding audio entertainment market, consumers have a huge array of choice - and sometimes they don't want to settle for one," Sirius CEO Mel Karmazin said in Tuesday's Wall Street conference. "We are part of a highly competitive and rapidly evolving marketplace," he said, noting that consumers today have many audio entertainment options that didn't exist when XM and Sirius were first conceived over 10 years ago. "Together the combined company will be better positioned to compete in our dynamic industry," Karmazin said. To win approval of the merger, XM and Sirius will have to convince regulators and lawmakers that satellite radio should not be viewed as an industry sector unto itself, but as a tiny part of a much larger marketplace. The bar chart shows XM and Sirius combined as the smallest bar, with 14 million combined subscribers - far eclipsed by 230 million weekly listeners to AM-FM radio, 219 million cell phones and even 39 million iPods. While the payoff for Wall Street investors will be in cash flow generation from eliminating duplication, XM and Sirius insist that consumers will benefit as well. They say the merged company will be able to move faster on introducing smaller, lighter and cooler receivers - and that the "robust" competition from other audio services will keep a lid on the prices they can charge for satellite radio. "This transaction is about choice," said XM Chairman Gary Parsons. No longer, he said, will subscribers have to choose between Howard Stern and Opie & Anthony, or between Oprah and Martha Stewart.

RBR observation: Gary, you might want to lose the reference to Howard Stern and Opie & Anthony when you get to Capitol Hill next week. Giving subscribers access to twice as much programming that would not pass the indecency standard for broadcast radio is not something that is likely to win you many friends in Congress.

Subscriber group dead set against merger

It was just last month that the Consumer Coalition for Competition in Satellite Radio (C3SR) was formed (1/13/07 RBR #9) by satellite radio subscribers who don't want to see the two satellite radio companies become one, eliminating any competition and consumer choice. Now they have an actual fight on their hands. "If this merger is permitted to go forward, there will be no protection of competition and there will be no competitors," said C3SR co-founder Chris Reale, a law school student in Washington, DC. He noted that "a monopoly satellite radio provider would be able to raise prices and cut programming to a growing number of consumers that have come to rely on satellite radio for news and entertainment." C3SR said it will be seeking support from Sirius and XM subscribers to oppose the proposed merger, along with aligning with other consumer groups and "key industry allies" who oppose the merger. "Our main goal right now is to stop this merger. If a merger were to be approved, subscribers would likely end up paying more for less programming, and would end up subsidizing unwanted services," Reale said.

|

|

|

Is media clouded Is media clouded

with private equity?

Academic Eli Noam has turned his spotlight on the rapidly increasing share of media owned by private equity companies. Although there are positive aspects to this trend, in his opinion it brings with it inherent dangers. Primarily, we need to know about the companies that themselves are needed by society to "inform and shine light." Writing in Financial Times, Noam noted that the entry of private equity does have its good side, and pointed in particular to the massive sell-off coming from Clear Channel as it moves toward completing its own move into private equity land, executed, he said, to reduce debt. "On the negative side, the same cost-cutting has impacts on newsrooms, film budgets and research and development." He said that as opposed to start-up venture capital, this kind of takeover is designed conservatively, to increase cash flow and "position the company for resale." Such companies, he noted, keep a distance from day-to-day media operations, but hire management to watch overhead and the stock price, above and beyond anything else. "In open societies, large media holdings must be in the open. Direct regulation by government of media operations is undesirable. But disclosure is another matter." He said basic information about these companies must be out in the open, using as they do the public infrastructure, and given their unique responsibility to the public, whether they are publicly or privately owned.

RBR observation: We caught Noam's act at a Washington think tank back in 2003, and at the time he was pointing out that US media companies were not all that consolidated compared to other industries. Back then, he thought perhaps that even though the concentration percentages had increased fairly rapidly, it really wasn't all that much to worry about. He has seemingly backed away from that lassez faire position in the meantime, and is now saying that media companies have a public responsibility unique in comparison to other businesses. He has made a name as a student of the big media picture, so don't be surprised to see his point of view referred to as the FCC moves ahead with the ownership remand.

To live and compete in LA

A David and Goliath battle is being waged at the FCC between Clear Channel and small, local Los Angeles radio company Mount Wilson FM Broadcasters. MWFMB says that Clear Channel is behaving in an anticompetitive way by signing advertisers to exclusive contracts, and Clear Channel is asking for proof. According to a publication called Lasar's Letter, Mount Wilson provided the FCC with anecdotal evidence of former and potential advertisers on its stations, who said they either had to cease using Mount Wilson or couldn't start because they were in a deal limiting them to using stations in Clear Channel's cluster. Clear Channel is said to have responded that the charges from Mount Wilson are not specific enough to comment on, and stated that it has no written or oral policy restricting any advertisers to its stations. Mount Wilson is using the occasion to try and block Clear Channel's pending sale to an equity fund.

RBR observation: Clear Channel attracts lawsuits the way a picnic attracts ants, and very rarely do any of them seem to go anywhere. The burden is certainly on Mount Wilson, and we would guess that it's going to need more than the affidavits it sent to the FCC from its president and two sales staffers. If they can get some of the advertisers to go on the record, then things might get interesting.

|

|

|

|

| Executive Comment |

This is in response to... This is in response to...

Steve Morris' reported " concerns about the way cell phones are carried by participants, versus a dedicated pager-like device, and noted that young demos are much more likely than oldsters to carry cell phones religiously" as stated in your article "Arbitron keeping its PPM options open." (2/19/07 RBR #34)

Where the heck is the research that supports that nonsense? For years Arbitron has agonized over how to increase sample return from "young demos," especially young men. If younger demos are, in fact, carrying a cell phone more religiously as Morris claims, here's a way to reach them and solve a problem that Arbitron has fumbled for decades. Pagers are antiquated technology that will perpetuate the alienation of young demos from Arbitron research. And who are these "oldsters" anyway? I'm 66 and carry a cell phone 18/7. My father is 87 and carries one 12/7. When is it we fall into that oldster abyss? Do advertisers care about us anyway? According to them, life ends at 54! And by the way, I personally have never carried a pager. Sorry Steve.

Rick Guest, Market Manager

East Texas Radio Group

Tyler, TX

|

|

|

|

|

Ad Business Report TM

|

30-second radio units on the rise

Interep announced the increase in short form radio spots (spots shorter than the standard :60 radio commercials) is reaching new heights, as a growing number of advertisers are requesting :30, :15 and :10-second announcements as part of their spot radio campaigns. From 2004 to 2006, Interep saw the following increases in the percentage of short form radio commercial units sold:

:10/:15-second spots, up 400%

:30-second spots, up 1000%

Total short form spots, up 680%

Interep said that despite this steep increase, short form spots still comprise only about 10% of its total billing, with :30s representing about 7%. This compares to a recent report by BMO Capital Markets stating that 30-second spots comprised 19.9% of total radio commercial time in January 2007. Said Kirk Combs, General Manager, Interep's D&R Radio: "Clearly, we are going to see more and more business availed in 2007 requesting shorter form commercials. The Interep numbers, as well as supporting industry data, speak for themselves. We respect our clients' need to manage their inventory in accordance with their overall programming objectives, and we want to make them aware of this growing trend to assure that we collectively can aggressively compete for the swell of new radio dollars going to short form advertising."

|

|

|

|

| Media Business Report TM |

Here come the fictomercials Here come the fictomercials

"It was the best of times, it was the worst of times...it was time for an ACME Diet Cola." So might Charles Dickens have kicked off "A Tale of Two Cities." Herman Melville could have penned the line "Call me Ishmael. But call me with unlimited evening minutes on ACME Cellular" to kick off "Moby Dick." Before you start laughing, we direct your attention to Mark Haskell Smith's "Black Sapphire Pearl," a novel in thriller genre starring a Lexus automobile. Washingtonpost.com calls the new advertising form a fictomercial or a literatisement. To concept is not new. We started this article off with a Dickens joke, but according to the Post, Charles Dickens actually expanded a hotel ad he once wrote into a novel, and besides "The Pickwick Papers," there was a Pickwick company offering carriage rides at the time. But in the age of ad-skipping, fictomercials is just one more way to slip in some more advertising.

RBR observation: And yet another hungry mouth bellies up to the advertising pie...

|

|

|

|

| Media Markets & Money TM |

EMF expands its Galaxy

Ed Levine is spinning three upstate New York FMs to noncommercial Educational Media Foundation. Included in the deal are two in the Albany-Schenectady-Troy area, WOOB-FM and WBOE-FM; and one in the Syracuse area, WSCP-FM. According to brokers Bill Schutz, who worked with Levine, and John Pierce, who worked with EMF, the price is 3.65M. All three are Class As, and are updial from the reserve band. WBOE-FM hails from 94.5 MHz in Ravena NY, WOOB-FM is licensed to 94.5 MHz in Scotia, and WSCP-FM is on 101.7 MHz out of Pulaski. According to the BIAfn 2006 Investing in Radio Ownership Report, the deal will take Galaxy out of the state capital market, but it will still have extensive holdings in Syracuse and another outpost in Utica-Rome.

|

|

|

|

| Washington Media Business Report TM |

Keeping the non in noncommercial

A trio of FM stations in Texas have entered into a consent decree with the FCC over the issue of underwriting announcements on their stations. The licensee is CSSI Non-Profit Educational Broadcasting Corporation, and the stations are KSQX-FM Springtown TX and KMQX-FM/KYQX-FM, both out of Weatherford TX. The decree does not get into specifics, but it would seem that the licensee went a few degrees beyond the permissible in its underwriting announcements, which prohibit certain types of language common to commercial speech. Without admitting guilt, CSSI agreed that it is possible that it went over the line and will take steps to make sure future announcements are appropriate, including setting up a multi-layered review process and the hiring of a knowledgeable consultant. CSSI will also kick in 3K to the US Treasury. The FCC took the occasion to reaffirm CSSI's basic qualifications to continue being a licensee.

|

|

|

|

| Internet Media Business Report TM |

IAB opens DC office

The Interactive Advertising Bureau announced the opening of a Washington, D.C. office to oversee regulatory matters, legislative affairs, and public policy initiatives that affect the Interactive advertising industry. The IAB also announced that it had appointed Mike Zaneis as Vice President of Public Policy, a new position in the organization. Zaneis, 33, joins the bureau from the U.S. Chamber of Commerce in Washington, where he served as Executive Director of Technology and E-Commerce. "The Interactive media industry is committed to striking the right balance between consumer protection and a consumer's free online access to information and entertainment," said Randall Rothenberg, President and CEO of the Interactive Advertising Bureau. "The opening of an IAB Public Policy office in DC allows us to be front and center on all legislative and regulatory issues as we continue to build a world-class medium that has the highest level of transparency and accountability." The IAB's Washington Office will be located at 575 7th St. N.W., within the historic Terrell Place Building. The Interactive Advertising Bureau announced the opening of a Washington, D.C. office to oversee regulatory matters, legislative affairs, and public policy initiatives that affect the Interactive advertising industry. The IAB also announced that it had appointed Mike Zaneis as Vice President of Public Policy, a new position in the organization. Zaneis, 33, joins the bureau from the U.S. Chamber of Commerce in Washington, where he served as Executive Director of Technology and E-Commerce. "The Interactive media industry is committed to striking the right balance between consumer protection and a consumer's free online access to information and entertainment," said Randall Rothenberg, President and CEO of the Interactive Advertising Bureau. "The opening of an IAB Public Policy office in DC allows us to be front and center on all legislative and regulatory issues as we continue to build a world-class medium that has the highest level of transparency and accountability." The IAB's Washington Office will be located at 575 7th St. N.W., within the historic Terrell Place Building.

|

|

|

|

| TVBR TV News |

NBC Universal Time Warner AOL Inc.?

Former NBC Universal Chairman Bob Wright says in an interview with Fortune magazine that he sees a merger of NBCU with Time Warner as a real possibility. "It would be a great combination," he told the magazine. The key is that next year Time Warner can separate its cable business from its other operations without a tax hit, which could spur efforts to combine Time Warner with NBCU. Although he continues to be Vice Chairman of General Electric, Wright was amazingly candid in the Fortune interview. He disclosed that the network was almost sold twice by GE during his 21-year tenure. The first was when Gulf + Western CEO Martin Davis came close to buying NBC to operate it in conjunction with Paramount, but he eventually sold the studio to Viacom instead. The second was a deal to sell half of NBC to Disney, with the expectation that Disney would eventually buy the other half as well. According to Wright, Disney CEO Michael Eisner changed his mind after sleeping on the idea for one night. A year later, Disney bought CapCities/ABC.

|

|

|

|

| Transactions |

300K KOPY AM & FM Alice TX from Sendero Multimedia Inc. (Alberto Munoz II) to Claro Communications Ltd. (Gerald Benavides). 25K escrow, balance in cash at closing. Duopoly with KROB-AM Robstown & KMZZ-FM Bishop, which are both considered to be part of Corpus Christi. KOPY AM & FM are outside all Arbitron markets. [File date 1/30/07.]

|

|

|

|

| Stock Talk |

Stocks manage gains

A bad earnings report from Home Depot didn't completely overshadow Wall Street excitement over the proposed XM-Sirius merger and a better than expected earnings report from Wal-Mart. The Dow Industrials managed yet another record close, rising 19 points to 12,787.

Conventional radio stocks didn't rise as much as their satellite rivals, but the Radio Index did move up 1.512, or 0.9%, to 162.333. Salem jumped 10.1% with no news about the company. Entravision rose 3.2%.

|

|

|

|

| Radio Stocks |

Here's how stocks fared on Tuesday

| Company |

Symbol |

Close |

Change |

Company |

Symbol |

Close |

Change |

|

Arbitron

|

ARB

|

|

46.10

|

+0.34

|

Journal Comm.

|

JRN

|

|

13.32

|

+0.01

|

|

Beasley

|

BBGI

|

|

9.19

|

+0.06

|

Lincoln Natl.

|

LNC

|

|

70.72

|

-0.07

|

| CBS CI. B |

CBS |

|

31.95

|

+0.14

|

Radio One, Cl. A

|

ROIA

|

|

7.49

|

+0.09

|

| CBS CI. A |

CBSa |

|

31.92

|

+0.14

|

Radio One, Cl. D

|

ROIAK

|

|

7.49

|

+0.07

|

| Citadel |

CDL |

|

10.44 |

unch |

Regent

|

RGCI

|

|

2.92

|

-0.06

|

|

Clear Channel

|

CCU

|

|

36.43

|

-0.02

|

Saga Commun.

|

SGA

|

|

9.47

|

-0.17

|

|

Cox Radio

|

CXR

|

|

15.70

|

+0.05

|

Salem Comm.

|

SALM

|

|

13.56

|

+1.24

|

|

Cumulus

|

CMLS

|

|

10.26

|

-0.05

|

Sirius Sat. Radio

|

SIRI

|

|

3.92

|

+0.22

|

|

Disney

|

DIS

|

|

35.05

|

+0.16

|

Spanish Bcg.

|

SBSA

|

|

4.45

|

+0.25

|

|

Emmis

|

EMMS

|

|

8.53

|

-0.14

|

SWMX

|

SMWX

|

|

1.00

|

+0.20

|

| Entercom |

ETM

|

|

30.58

|

-0.03

|

Univision

|

UVN

|

|

35.94

|

-0.01

|

|

Entravision

|

EVC

|

|

8.76

|

+0.27

|

Westwood One

|

WON

|

|

7.10

|

unch

|

|

Fisher

|

FSCI

|

|

45.09

|

+0.24

|

XM Sat. Radio

|

XMSR

|

|

15.41

|

+1.43

|

|

Hearst-Argyle

|

HTV

|

|

26.24

|

-0.01

|

-

|

-

|

-

|

-

|

-

|

|

|

|

|

|

|

Bounceback

|

We want to We want to

hear from you.

This is your column, so send your comments and

a photo to [email protected]

If I were the FCC If I were the FCC

I would approve the Sirius-XM merger as long as they would agree to carry on HD chip inside the radios...then it would be non-monopolistic. They (Sirius-XM) will most likely have to give up some things to get this approved. Seems like a convenient way for the FCC to bring digital radio into the cars for several years to come. I don't think this merger creates impossible barriers for radio, but I do believe there is an opportunity to bring all the technical aspects in line with this deal.

Dan Mason

Dan Mason LLC

What would your recommendation be if you were the FCC? Join the discussion. Send your comments to [email protected]

|

|

|

Below the Fold

|

|

Ad Business Report

30-second radio units on the rise

Interep ansylsis show the increase in short form radio spots...

Media Markets & Money

EMF expands its Galaxy

Ed Levine is spinning 3 upstate New York FMs to...

Washington Media Business Report

Keeping the non in noncommercial

A trio of FM stations in TX entered into a consent decree with the FCC...

Internet Media Business Report

IAB opens DC office

Oversee regulatory, legislative, public policy initiatives that affect the Interactive advertising industry...

|

|

|

Stations for Sale

|

NorthEast FM's For Sale

Clusters, standalones, sticks

8x - 12x BCF, 950K - 7.2M

[email protected] or

781-848-4201

10 TX, AZ, NC, and GA

FM radio stations at an exceptional value offered for sale. Broker cooperation encouraged. Please visit www.toweritrust.com for complete information including pricing.

Market your Stations For Sale Market your Stations For Sale

in our daily epapers.

Contact

June Barnes

[email protected]

|

|

|

Radio Media Moves

|

Windy City promotion Windy City promotion

Bonneville International has promoted Jerry Schnacke to Vice President and Market Manager for its Chicago Radio group, including WTMX-FM, WILV-FM and WDRV-FM. Schnacke was previously VP/GM of WDRV.

Jack's new Kidd

Jason Kidd, who had previously programmed WWMX-FM Baltimore, is back with CBS Radio in Charm City as PD of WQSR-FM "Jack FM" and the Mainstream Top 40 HD-2 channel of WWMX.

Sohinki to TNS

TNS Media Research announced the appointment of Jeff Sohinki as Director of Business Development, responsible for managing client sales and service for television programmers and advertisers utilizing new set-top box viewing data as well as InfoSys, TNS' TV and radio audience analysis software. Jeff comes to TNS from Nielsen Media Research, where he managed four national offices as Senior Vice President of the company's Local Cable Division.

|

|

|

More News Headlines

|

AND THEY'RE OFF!

In the early stages of the presidential race, governor candidates may have a problem with name recognition outside their home state. So one of this year's entrants, former Massachusetts governor Mitt Romney (R) is already hitting the airwaves with a getting-to-know-me ad that will hit select markets in five states, according to TPMCafe's Election Central. For the record, we feel we should have used the phrase "next year's" rather than "this year's" in the preceding sentence, and that pretty much tells you what kind of an election cycle this figures to be. Romney's campaign isn't saying how much it's spending or precisely where the ads are going to air, but the states are Iowa, New Hampshire, South Carolina, Florida and Michigan.

RBR observation: This would appear to be the first official confirmation of Victor Miller's prediction that this will be the biggest off-year for the political category ever. Let's see if it breeds a round of me-too ads from some of the other candidates. We have to say that it would be nice of the candidates to space the ads out as much as possible rather than trying to jam them all on the airwaves at once in the final week before polls open.

Warner Music

wants EMI

EMI Group issued a brief statement confirming that it has been approached about a takeover by Warner Music Group (WMG). EMI said there is not yet a formal proposal for its board to consider and it is too early to say whether the talks will lead to a formal offer from WMG. The stock price of UK-based EMI plunged this month after the company issued its second earnings warning in two months.

|

|

|

RBR Radar 2006

|

|

Radio News you won't read any where else. RBR--First, Accurate, and Independently Owned.

|

XM and Sirius merger plans

Will it ever happen? That is the big question, since combining the only two satellite radio companies in the United States will have to clear huge regulatory hurdles. One hurdle is NAB is all over this potential merger and as expected is against it. FCC Chairman says merger faces high hurdle. More details in RBR.

RBR observation: Despite the report issued last Friday by Bear Stearns analyst Robert Peck that an XM-Sirius merger would "likely pass" FCC and antitrust approval, we beg to differ. The companies would need three yes votes on the FCC and we can't imagine how they would find one. And should any Commissioner dare to indicate their support, they would likely rethink that position after being called to Capitol Hill for a very public bi-partisan flogging. To be sure, Wall Street investors love the merger idea. Both companies are burning through cash at an astounding rate and are far off the financial projections of their original business plans. Merging is expected to save 3-7 billion by cutting overhead and being able to raise subscription rates. But just how are XM and Sirius going to make the case for any public benefit from merging the only two competitors in a field? We can only think of one - as a single company they would likely finally comply with the FCC rule which requires their receivers to be compatible with each other's satellite system.

02/20/07 RBR #35

Daylight Savings switchover

may cause glitches

TDGA (Traffic Directors Guild of America) advises to take special care twice this spring. This is the first year that the Congressionally mandated change from Standard to Daylight Time in the vast majority of states occurs in March, rather than "The first Sunday in April."

RBR note: All should have a discussion with your traffic department executives as not to get caught sleeping at the clock. Be prepared.

02/20/07 RBR #35

Don't forget to vote!

RBR hears that the proxy solicitation firm hired by Clear Channel is beating the bushes to get out the vote. If you own a share or two, you may well have gotten a phone call urging you to return the proxy card and vote yes for the buyout by Bain Capital Partners LLC and Thomas H. Lee Partners LP, along with Mark and Randall Mays, for 37.60 per share. In fact, they are happy to take your vote right there and then over the phone. The votes will be tallied at a special shareholders meeting on March 21st. There is no indication any sweetener is in the offing, so this could end up resembling election night 2000 as we all waited for the votes to be counted in Florida.

02/19/07 RBR #34

|

|

|

|

|

General Sales Manager

Independent Aggressive Radio is Great Radio. Like that ring of Independent Aggressive Radio? Then add in a great city like Tampa and you never leave. GSM post is open for that aggressive radio pro that likes independent thinking. Like getting local direct business and working with and for your clients? Thinking out of the box the way radio must be to succeed. View our check list.

See Radio Careers

Hard finding that key person

to fill the important position at your organization? Media HeadHunters is the place that key media firms use to get results. See Media HeadHunters and get results with service--Period.

|

|

|

|

|

|

Help Desk

|

__EMAIL__ :

Having problems with our epapers?

Please send Questions/Concerns to:

[email protected]

If you wish to remove your name completely from our database use this link __UNSUB__

RBR Epaper --  108 annual 108 annual

or just  9 a month 9 a month

|

|

|

|

©2007 Radio Business Report, Inc. All rights reserved.

Radio Business Report -- 2050 Old Bridge Road, Suite B-01, Lake Ridge, VA 22192 -- Phone: 703-492-8191

|

|