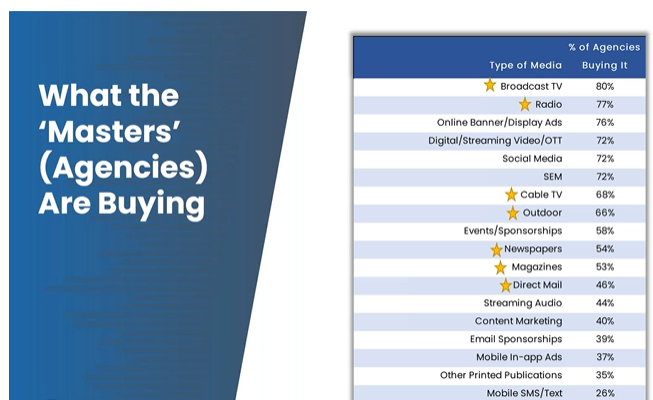

The results from Borrell Associates‘ Spring 2022 Local Advertiser Survey have been shared, and here’s the big takeaway from its query of some 2,418 agency and direct advertising buyers: the percentage of ad agencies buying broadcast TV and radio tops that of every other form of media.

But, online and digital media are very close behind.

In a webinar presented last week, Gordon Borrell, who heads Borrell Associates, shared that digital media, while purchased doesn’t dominate … yet.

“On average, agencies use eleven different types of media,” Borrell says. “The ones clustered more toward to the top of the list seems to be traditional forms of media. And, these are the ‘Marketing Masters’ and really know the mix of media required.”

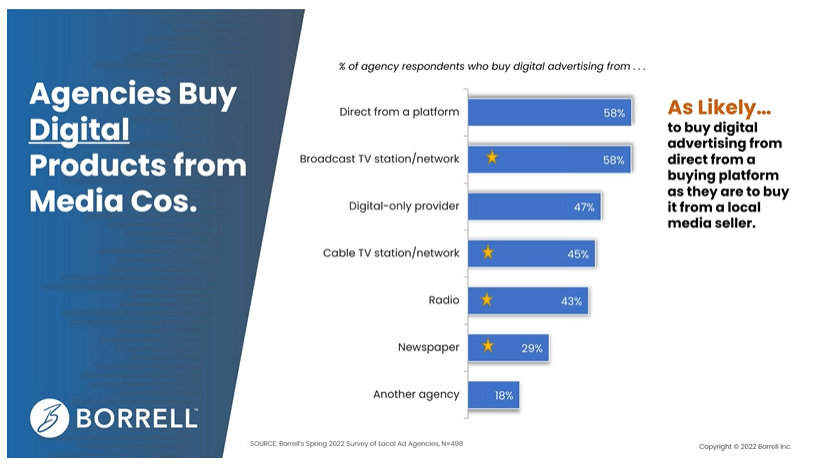

Borrell then turned to “a really interesting finding” pertaining to how agencies buy digital products from media companies. Agency respondents are as likely to buy digital advertising direct from a buying platform as they are to buy it from a local media seller.

“These agencies really need to marry up with the media companies, and vice versa,” Borrell advices. “The media companies themselves know a lot about marketing and their own particular medium.”

But, what do agencies foresee increasing across the second half of 2022? Some two-thirds of respondents predict higher interest for OTT and Social Media.

Digital/Streaming Video and OTT lead the higher interest levels, with a phenomenon coming out of the pandemic, Borrell believes. Social Media and SEM follow, with broadcast TV fourth. Interestingly, free-to-air television is higher than streaming audio.

Here’s the bad news for Radio: streaming audio (47%) is significantly higher than Radio (39%).

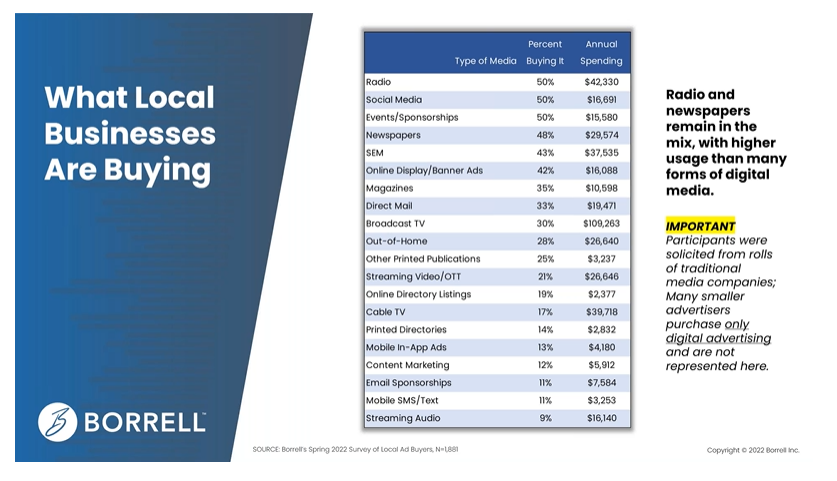

That’s not to say Radio is in a tough spot. On the contrary, the Borrell survey finds that 50% of local business are buying radio, and their average spend is $42,300 per year. But, half of local businesses are also buying social media. The average spend? Just $16,691.

“That number for newspapers has stayed the same for many, many years,” Borrell notes, emphasizing that, despite its three-decade decline, newspapers retain a particular desire among some local businesses.

Meanwhile, Borrell wonders if streaming audio buys among local businesses can grow. “It is stagnant,” he shares. “Those of you who have a podcast product, I know you’re going to be disappointed in that. But … the streaming audio issue is probably related to podcasting being a national phenomenon. There aren’t a whole lot of local podcasts out there.”

Among the few successful hyperlocal podcasts is Beach Talk Radio, a Saturday live news and issues offering co-hosted by Radio Ink Editor Ed Ryan from Fort Myers Beach, Fla.

What are local ad buyers increasing and/or decreasing? The Borrell study finds that, for Radio, 12% plan to start or increase their buying. But, “it is not good” that 11% plan to trim their radio buying,” Gordon Borrell said. “It tells us that Radio might be a bit treading water.”

A 5% FY2022 increase, ex-digital, is expected for Radio industry ad growth by Borrell.

Lastly, some 70% of the roughly 1,000 advertisers who were buying OTT were buying radio advertising, spending an average of $78,000 per year on radio advertising, Borrell concludes. “That is 85% more than the average expenditure on radio.”