This story would usually be locked. Subscribe today and save.

It’s hardly a surprise that revenue projections for 2020 local advertising would be adjusted downward. The lone question was how much of a contraction would be caused by the COVID-19 pandemic, with respect to U.S. economic conditions.

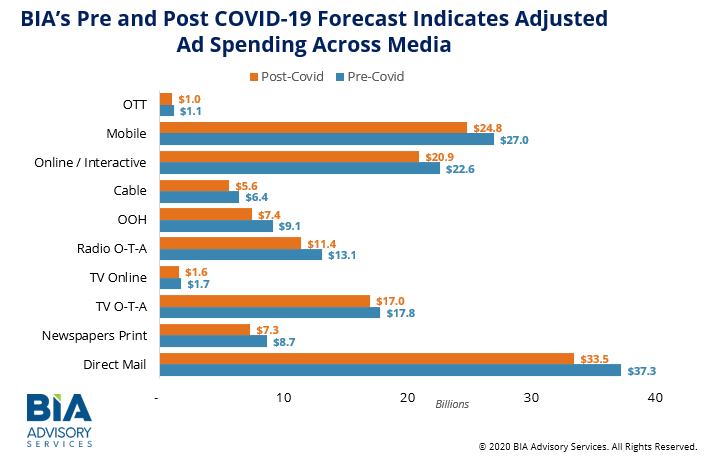

BIA Advisory Services has its new revenue projections in, and a double-digit dollar slice is being forecast.

The total local advertising market for all of 2020, according to BIA data, is now forecast to be $144.3 billion. This reflects a 10.6% decrease from BIA’s prior estimate of $161.3 billion, made in November 2019, well before novel coronavirus pandemic concerns surfaced.

How does the new total compare to all of 2019?

The new estimate represents a 3.6% decline from 2019 — even with the anticipated political advertising revenue of $7.1 billion set to surface across 2020.

The ad revenue decline has ravaged the media industry, and BIA notes that as of April 21, the M&E sector had the second-highest percentage of issuers affected by ratings actions by Standard & Poor’s (including downgrades, negative outlook revisions, and negative CreditWatch placements) due to COVID-19, oil prices, or both—second only to the automotive industry.

“To formulate the update to our local advertising estimates, we considered all the different angles of the economic impact of COVID-19 on the economy, including unemployment, local market specific factors, and the declining ad spend of key business verticals,” says Dr. Mark Fratrik, BIA’s Chief Economist. “A realistic view of the virus is that it will continue to have a negative impact on the second quarter, with some continuation into the third quarter. We have assumed that there will be a strong rebound in the latter part of the year, but we will have to re-evaluate as the on-going economic impact becomes clearer.”

As seen above, BIA’s pre-COVID and post-COVID estimates for different media channels indicates that advertisers are pulling back on spending.

This, again, is no surprise to Wall Street, with some high-profile media companies such as Entercom Communications experiencing significant declines in its stock price due to a combination of factors — including high exposure to live sports, the cost of running all-News stations in the nation’s biggest markets, and laggard music stations in markets such as Los Angeles that have not seen the revenue or ratings turnaround the company had hoped for in the months since assuming former CBS Radio stations.

Local Radio and Local Television were both impacted by decreased ad spend by Leisure and Entertainment, Restaurants and Retail companies, as well as sports cancellations.

One encouraging sign for local television isn’t being mentioned for radio, however: political advertising will keep the decrease in both local cable and local OTA television smaller than other media, BIA says.

“Other media, without that buffer, will see larger percentage decreases from what BIA originally projected for 2020,” the company says.

The health sector business vertical is also expected to see a slight increase in ad spending, as hospitals and health professionals will become highly sought after, BIA adds.

“As this situation unfolds, we are continually running our forecast models to make sure our estimates reflect economic conditions,” says BIA CEO Tom Buono. “This unprecedented moment is greatly affecting our clients’ revenue opportunities, and we believe businesses can use solid data and insights to take steps to minimize their losses and take steps to plan for the recovery.”

Buono says that he has been advising client companies in the media industry to take several steps now to keep their companies going and then preparing for the economic rebound in three key areas: preserving liquidity; emphasize and manage relationships; and, think forward as a team.

“Preserving liquidity” is perhaps a paramount effort at Entercom, which on March 25 drew $96.5 million under the revolver portion of its credit agreement. The move came after Entercom on March 18 drew $50 million from this credit facility.

While that’s much less than the $350 million drawn by iHeartMedia, Entercom’s drawn dollars “constitute substantially all remaining amounts available under the revolver,” it says. In iHeart’s case, some $100 million remains on its credit line.

Meanwhile, Urban One drew $27.5 million from its asset-backed credit facility, as Townsquare Media borrowed $50 million under the revolving credit facility portion of its credit agreement dated April 1, 2015 with administrative agent Royal Bank of Canada (RBC).

For Townsquare Media, this is the entire amount available under the revolving credit facility portion of its Senior Secured Credit Facility.