“Mobile advertising revenue is growing rapidly on all fronts, with the mobile social advertising segment contributing the most to overall spending growth,” notes BIA Advisory Services in a just-released updated local advertising forecast for 2019.

With national advertisers driving a large portion of the localized share of mobile ad revenue, mobile’s percent share is big.

In fact, it’s some 50% larger than Local Radio’s share of ad revenue expected this year.

Is this a harbinger of opportunity, or added worries, for broadcast radio’s cognoscenti?

Given the technology available for radio stations today, the former may be the answer for those companies that have professed savvy in reaching consumers via digital platforms while investing in the smartest online opportunities for sales and revenue growth.

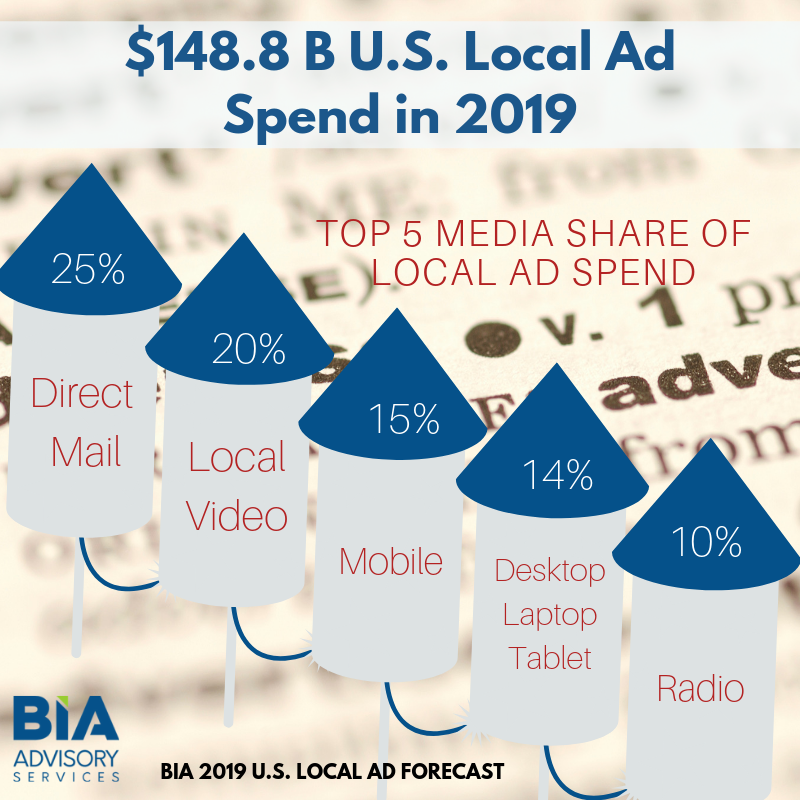

BIA Advisory Services’ new forecast calls for slightly stronger ad growth than anticipated in early 2019, and the total local media marketplace is benefiting as ad revenue will reach approximately $148.8 billion.

While a strong economy, buoyed by a great June jobs report, are factors, it is “most notably” increases in mobile and mobile-social advertising that warrant a technology overview in the C-Suite.

There could be money for the taking, and smart radio companies are already one step ahead.

As BIA notes, the future of online/digital advertising revenue is progressively increasing, with a 2018-2023 CAGR of 9%. Over the same period, traditional advertising revenues will see a decrease in the 2018-2023 period with a CAGR of 1.4%.

“This is a very interesting time for local media,” said Dr. Mark Fratrik, SVP and Chief Economist at BIA Advisory Services.

Early political dollars could be a positive for all media.

“Although it’s a non-political year, the sheer number of Democratic candidates running and the significant attention this presidential race is garnering is driving earlier than usual advertising revenue across television and mobile/social channels,” he said. “Additionally, we are more bullish on certain digital advertising platforms like mobile due to its targetability, measurability, attribution and high level of adoption by consumers.”

BIA’s forecast puts Direct Mail as the No. 1 media, by revenue and share of market, in local advertising for 2019. With 25% share and $37.2 billion in ad revenue, direct solicitation, couponing and catalogs remain an effective means of communication to reach certain households for national and local advertisers.

Local video, which includes local Over-the-Air TV, local cable, local online video, out-of-home video, and mobile video, has a 19.9% share, capturing $29.5 billion ad dollars.

Again, it is mobile that is driving this, along with online activity.

Mobile is No. 3, with its 14.6% share and $21.8 billion in revenue.

Then comes online/interactive, defined as desktop/tablet/laptop. This category merits a 13.6% share, with $20.2 billion in ad dollars, even as eyes and use shift from the PC to the smartphone.

Radio is far behind, with a 9.8% share and some $14.5 billion in ad revenue.

What’s the media’s silver lining? Fratrik notes, “Competition for audiences continues to erode over-the-air (OTA) advertising revenue, however online efforts by stations are helping to support a slight growth in overall revenue.”