When it comes to profits and political advertising, the game plan is paying off big time for Sinclair Broadcast Group.

The Baltimore-based broadcast TV station owner that also owns Tennis Channel and the Bally Sports regional sports networks, in addition to the Comet, Charge! and TBD digital multicast networks, enjoyed an incredibly strong Q2 for political ad dollars.

The trends for Q3 are bright, too, leading to “crowdout” for core advertising that one analyst wanted more details of during the company’s second quarter 2022 earnings call held Wednesday morning.

Speaking ahead of the Q&A session on the earnings call, Sinclair EVP/CFO Lucy Rutishauser shared guidance of “another strong revenue” quarter for political in Q3. Compared to last year on a pro-forma basis, 10%-12% growth is anticipated.

As such, traditional revenue is anticipated to be flat to down by low single-digit percentages, due to “crowdout” from political in addition to the absence of an Olympic Games and “macroeconomic factors” — a.k.a. recessionary worries in the marketplace.

How big was the political advertising revenue for Sinclair in Q2? It totaled $54 million.

This pushed Q2 ’22 broadcast and “other” total advertising revenue to $366 million, up 11% year-over-year.

“Year-to-date, political advertising revenue is also at all-time record levels, doubling the amount achieved during 2018, the last mid-term election year, and 20% higher than 2020, a Presidential election year,” said Chris Ripley, President/CEO of Sinclair Broadcast Group. “With even higher political ad revenues anticipated for our third and fourth quarters, which are typically the largest quarters for political spend, we believe 2022 political ad revenues could approach 2020’s levels.”

That’s an outstanding outlook, and Steven Cahall, the Managing Director, Senior Analyst – Equity Research at Wells Fargo Securities who recently set a target price of $0.00 for Audacy Corp. shares, wanted more context on what drew such strong political results in Q2 versus 2018 or 2020. Was it issue-oriented political advertising? Did Political Action Committee (PAC) dollars also fuel the growth?

Sinclair Chief Operating Officer and President of Broadcast Rob Weisbord noted that across the first half of 2022, voters were presented with issues on religion, abortion, gambling, firearms, the minimum wage and other matters of interest to the electorate. “All of those factors are going to drive revenue,” he said on the earnings call in response to Cahall. Weisbord noted that, in Florida, $20 million has been raised there for political advertising.”

Sinclair operates four television stations in West Palm Beach-Boca Raton-Vero Beach, a DMA that to its south is a liberal Democratic bastion and across the north is overwhelmingly Republican and conservative.

As such, its CBS affiliate, WPEC-12 in West Palm Beach, stands to benefit from a flood of political ad dollars. Other stations in the cluster include a low-power Azteca TV affiliate serving Spanish-speakers; it is the lone locally based en español TV station.

Sinclair also operates stations in Gainesville-Ocala, Pensacola and in the state capital, Tallahassee.

Overall, political “will artificially tighten up our supply,” Weisbord notes. As such, advertisers will experience increased rates “due to diminished inventory” — with political “crowdout” inevitable.

ENGINE TROUBLE FOR AUTOMOTIVE?

That “crowdout” was on the mind of Dan Kurnos, Senior Research Analyst at The Benchmark Company, who kicked off the Q&A session on the earnings call. He took a magnifying glass to the financials and pulled the political dollars out of the broadcast station revenues. Kurnos’ assessment? Core “looks a little bit worse.” With national softening, in his view, how will Sinclair’s traditional advertising at its TV stations hold up?

Weisbord replied that, in Q1, Retail and Medical were strong ad categories and continued to perform well in Q2. But, the largest ad category — Services — saw some weakness due to an insurance subcategory decline.

Ripley elaborated on this weakness, which couldn’t come at a worse time for broadcast media. Auto insurance specialists have been among the top users of Spot Radio, Spot TV and Spot Cable for months, as determined by Media Monitors.

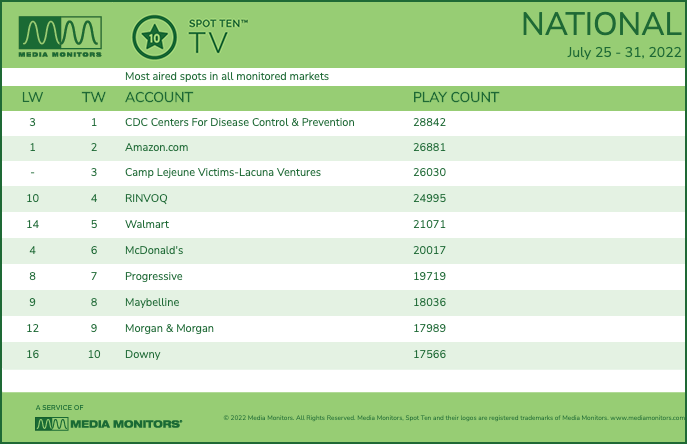

The latest Spot Ten TV report shows Progressive as the lone brand in the top 10 for the week ending July 31.

The cable TV portrait is a bit more robust. As seen below, for the week ending July 31, Liberty Mutual Insurance was the second-biggest user of Spot Cable while GEICO was No. 4 and Progressive was No. 5. Given Sinclair’s exposure in the cable TV world, any discussion of an auto insurance ad slowdown is perhaps disconcerting.

With insurance going through what Ripley terms “various issues,” Weisbord turned attention toward Automotive — a category that’s been battered for two years. For Sinclair, Auto is now expected to have “a new normalized look” until the chip supply is fixed.

For Townsquare Media, the digital-first local media company with radio stations in sub-Top 50 markets, Automotive may not come back until 2024, CEO Bill Wilson noted during that company’s Q2 earnings call on Tuesday.

Should Automotive and Insurance remain week, Weisbord is confident Sinclair’s local account executives will nevertheless shine. That’s because “how to sell through a down economy” is a topic of conversation local and regional clients are having with Sinclair station-level sellers.

BET ON THIS: SPORTS WAGERING IS FLATTENING

Another hot topic for analysts is sports betting, and what is being seen as a maturation phase for what had been a high growth category.

For Sinclair, revenue in the sports betting category will be down slightly as it has crossed the 50% threshold, with dollars moving to networks. When each state opens up sports wagering, “That’s when we expect to see the money coming in,” Weisbord said.

Ohio is next. But, right now, Weisbord noted, “It is flattened.” And, due to cost to acquire an active bettor, “there will be some consolidation” moving forward in the sports wagering category.

Is that cause for concern, knowing that there’s only so much state-by-state opening ahead? Ripley looks at the bigger picture. “This is a category that did not exist a few years ago,” he said. As such, it will end up a 5%-10% category upon maturity, Ripley believes. On RSN side, it continues to grow “incredibly strong.”

Meanwhile, Kurnos inquired about the mid-single-digit growth in retransmission fee revenue. What’s the trend? Rutishauser, who handles retrans matters for Sinclair, replied that the forecast is for continued mid-single-digit percentage growth. She added that it is too early to provide a 2023 retrans outlook. But, the fourth quarter will see an ABC affiliate renewal period, while in the back half of 2023 just over 30% of subscribers renew, Rutishauser said.

SINCLAIR BROADCAST GROUP’S Q2 2022 BY THE NUMBERS:

- Total broadcast revenue grew to $732 million, from $687 million

- Local Sports is no longer being listed as its own revenue category

- Total Company debt as of June 30 was $4.276 billion

- During the second quarter, the company repurchased $118 million par value of Sinclair Television Group notes due 2027 at a $14 million discount