NEW YORK — As Forecast 2022 wound down and media executives gathered at the Harvard Club to socialize over cocktails for the first time in over 18 months, the Chief Executive Officer of Spanish Broadcasting System (SBS) had some big news to share.

On Friday morning, that information became public, putting Apollo Global Management and the media company it controls, Cox Media Group, on the hot seat. In short, SBS has asked the FCC to deny CMG’s request for additional time to divest two FMs in Florida — something that must be done per the terms of Apollo’s acquisition of CMG majority control.

SBS’s filing in what is officially labeled MB Docket No. 19-98 was made just in the nick of time, as comments, petitions or objections on the extension request were to be submitted no later than Wednesday.

And, the filing is chock full of SBS’s version of the facts, along with details of how much SBS is willing to pay, in cash, and the counteroffer presented by Elliot Evers, administrator of the “CXR Radio Station Trust.” That’s the entity presently in control of Alternative WSUN-FM 97.1 in Holiday, Fla., the Tampa Bay market station known as “97X”; and Rhythmic Top 40 WPYO-FM 95.3 in Maitland, Fla., an Orlando market branded as “Power 95.3.”

On this matter, Nancy Ory from Lerman Senter was not involved, due to a conflict of interest. As such, SBS went to Kathleen Kirby and Greg Masters at Wiley, and their nine-page letter advocating for a denial of CMG’s request is front and center — along with a bevy of materials SBS wants the Media Bureau to fully consider.

“SBS’s interactions with CXR in the course of its efforts to purchase WPYO have made clear that CXR’s failure to sell the station within the two years afforded it is not because of the pandemic, market conditions or any other reason outside CXR’s control, but because of inaction by CXR that stands in contrast to the public interest in eliminating the violation of the local radio ownership limits,” Kirby and Masters state.

To be clear, SBS’s filing deals solely with WPYO, a 12kw Class C3 FM with a city-grade signal within metropolitan Orlando; it does not reach Daytona Beach or the Space Coast cities of Melbourne, Titusville or Cocoa.

How SBS got to this point was offered in detail to RBR+TVBR in a conversation Friday morning with its EVP and General Counsel, Richard Lara. In Lara’s view, Evers, a senior advisor at San Francisco-based Houlihan Lokey who is not only the stations’ trustee but its media broker, offered reasons for not making a deal that “are not factually supportable under FCC rules.”

SBS’s quest for WPYO began in earnest on August 26, when Lara had his first conversation with Evers. With a Dec. 17, 2021, divestiture deadline approaching, the two briefly discussed SBS’s interest in the FM. According to Lara, Evers brushed him aside, suggesting that Lara “should ignore the deadline.” Furthermore, Lara claims Evers boasted that “he could get an extension within four hours” by making calls to the Media Bureau and that he is the person “who dictates” to the FCC what to do in such instances and that the Audio Division does not contradict him.

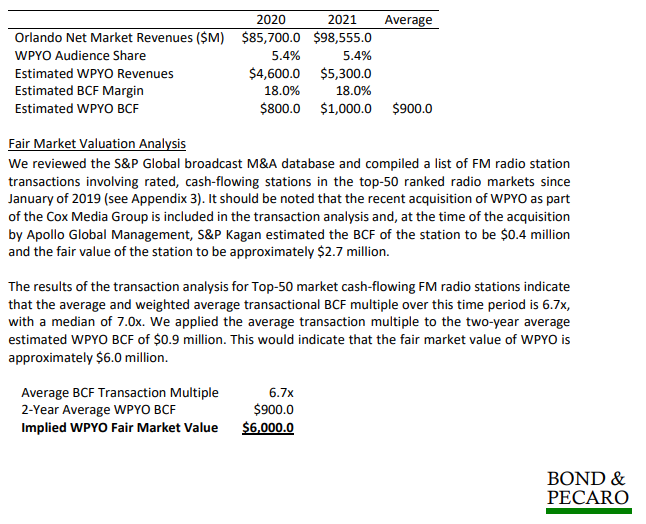

Undeterred, SBS moved ahead with making three all-cash offers, the final offer coming in ahead of the highest appraisal value presented by Bond & Pecaro.

The appraisal firm reviewed total radio market revenue data from Miller Kaplan for 2020 and May year‐to‐date 2021, as well as market radio revenue estimates for 2020 from S&P Global. Based on this information, the total 2020 market net radio revenues for the Orlando radio market have been estimated to be $85.7 million. The implied Orlando market net radio revenues for 2021 are forecasted to be $97.8 million. This led Bond & Pecaro to put the highest valuation of WPYO at $6 million.

According to Lara, that wasn’t acceptable. Evers presented a counteroffer of $10 million. SBS balked. “We were the only ones to our knowledge who had presented a bona fide all-cash offer above the market appraisal in a timely manner,” Lara said. “If only one individual shows up in the marketplace to buy WPYO, then I don’t think the one offer that comes in is not the market price.”

Evers disagreed, and on November 8 filed a request seeking Media Bureau authorization to delay the CXR divestiture deadline to Dec. 17, 2022 — one full year. The reasons stated include the COVID-19 pandemic and deflated station valuations. In this case, however, Lara believes those reasons are invalid, and that Evers simply cannot keep WPYO, or WSUN, off the market as a trustee facing a regulatory divestment deadline.

KEEPING THE COMPETITION OUT?

While Lara believes Evers’ actions are a “textbook case of why it is nearly impossible for a minority buyer to enter a market,” as the purchase of WPYO would make SBS the first minority-certified, Hispanic-owned media company to own an FM in Central Florida, there is another important factor that suggest CMG is doing everything in its power to sell one of its properties to what would be a direct competitor.

In late June 2020, the Orlando market’s Hispanic options further evolved as Cox Media Group’s 99kw Class C WDBO-FM — once a Classic Rocker under the WHTQ calls — flipped to what is best-described as a Puerto Rican-influenced Spanish Adult Contemporary presentation as WOEX “Exitos 96.5.” Today, Exitos is the No. 1 Spanish-language radio station in Orlando, according to Nielsen Audio audience estimates for October 2021 and is in a fierce battle against iHeartMedia-owned WRUM-FM “Rumba 100.3,” which has a 6.1 share compared to Exitos’ 6.2 share. Other Spanish-language radio offerings include FM translators and AM radio signals, making Orlando a vibrant Hispanic market that could support a third full-signal FM serving the metropolitan area.

But, why would Evers, CMG and Apollo ever want to sell WPYO to a company that would draw listeners and advertisers from Exitos? “You’ve teed it up perfectly,” Lara said when the suggestion was made that the $10 million counteroffer was done to scare off SBS, or factor in a likely ratings and revenue dip once WPYO got into the hands of Jesus Salas, SBS’s longtime radio programming leader.

“There is a ‘pandemic facade’ to Evers’ reasoning,” Lara tells RBR+TVBR. “Not selling to a direct competitor is a privilege they could exercise in a free market. But, this particular case involves a FCC mandate, and to continue to hold it renders this obligation to sell it completely essential.”

In response to RBR+TVBR‘s request for comment, Evers replied via e-mail, “No comment on the process, or SBS’s offer, except to say that we will be filing our Reply Comments in a timely fashion.”

Already, the reaction from Hispanic marketing and media leaders has been swift, and vocal. Gene Bryan, CEO and publisher of HispanicAd.com, a trade journal covering Hispanic advertising and media buying, notes that Evers’ resistance to SBS’s offer hinders the U.S. Hispanic market opportunities found in Orlando.

“If there was a viable marketplace, then general market operators would be coming in,” Bryan said. “Cox has to divest, and this could be a general market situation. But, SBS is the one to make an offer, and they don’t like the offer. Look … it is not an issue of SBS, it is a situation of the marketplace. [SBS Chairman/CEO] Raúl Alarcón Jr. is the only suitor. And, if he isn’t able to make the deal, it is the Hispanic community that loses out. SBS is taking advantages of market conditions, and FCC law.”

RULEMAKING ROULETTE

“[We] believe it is in [Cox Media Group’s] best interest to continue to hold the station off the market until such time as improvement in performance justifies a significantly

higher price,” Evers wrote to Lara on September 2, following SBS’s first offer.

Then came a second offer, on September 28. RBR+TVBR has independently confirmed that this all-cash bid was valued at $5.25 million. Evers declined to consider it.

On October 21, SBS powered up its pursuit of WPYO by providing Evers a letter from Ambassador Philip L. Verveer, a veteran communications attorney and former Senior Counselor to the FCC’s Office of the Chairman. The letter in support of SBS was submitted to the Media Bureau along with its other documents.

Verveer points to a March 16, 2018, decision by Al Shuldiner, the Audio Division Chief inside the FCC’s Media Bureau, that granting the transfer application of WJJS-FM in the Roanoke, Va., market — a required divestment in the same vein as that of WSUN and WPYO — relied upon the “express commitment … ‘to consummate a sale or sales of each of the stations as soon as reasonably practicable after the closing … at prices that render to [the private equity funds] the maximum consideration reasonably attainable …’.”

Shuldiner further explained in his 2018 ruling that the trustee’s excuse for rejecting offers—”that the radio station market ha[d] not yet returned to ‘vibrant’ pre-2008 levels” — was not “persuasive.”

Given that determination, Verveer believes a similar decision is warranted in Orlando. “The fact that an offer is pending indicates that the time the Commission has allowed the parties to come into compliance has been sufficient to enable the trustee to meet its obligation,” he said. “The severe disruptions caused by the pandemic, to take the most serious difficulty posed to business as usual, have not in fact prevented the successful completion of transactions in the media space. Between March 2020 and the present there have been 332 radio station and 36 television transactions.”

Verveer’s letter wasn’t persuasive to Evers. On October 22, Evers replied to SBS, stating, ” “Your proposal falls well below the level at which we think the station will eventually sell.”

That led SBS on November 3 to offer a third bid for WPYO, at a price that exceeded the $6 million maximum valuation presented by Bond & Pecoro. Five days later, CXR filed its FCC extension request. Then, on Nov. 9, Evers emailed Lara with his first counteroffer, at a value $4 million higher than the highest Bond & Pecaro appraisal.

For SBS’s legal counsel at Wiley, waiting for a better offer that could never come is unacceptable. “Regardless of general assertions regarding the pandemic and its effects on the radio industry and deal market at large, CXR has an interested buyer for WPYO,” Kirby and Masters write. “CXR’s delay is of its own doing.”