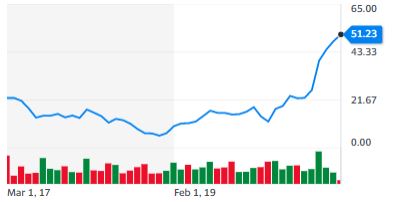

Snapchat’s purpose on smartphones may still be questioned by some, despite Radio’s use of its social media platform to connect with listeners. Yet, there’s no question that Snapchat’s parent company has had one of the hottest stocks on the NYSE since the start of the COVID-19 pandemic.

With Tuesday’s close, it is more than $42 per share above its March 11 level.

At the closing bell, SNAP was priced at $51.23, up 6.2% from Monday.

With a recent high of $53.25, seen December 17, Snap Inc. is on a roll.

And, it came even as Election Day jitters put a sputter to SNAP’s meteoric rise in 2020.

As the novel coronavirus became a big threat on March 11, SNAP shares were valued at $8.91.

Prior to that, SNAP had reached the $18.38 level at the start of 2020, and came off a strong 2019 that began with shares in the mid-$6 range.

Kiss that growth goodbye.

SNAP is certainly crackling. Now, it’s ready to perhaps pop.

Goldman Sachs has raised its target price on the issue to $70 per share, with analyst Heath Terry predicting Snap Inc. will beat its own Q4 2020 guidance.

The $70 target is a 45% premium to Monday’s close.