BIA Advisory Services has released its U.S. Local Advertising Forecast for 2021. What is it predicting?

Growth is the magic word, with a 2.5% year-over-year increase from a year battered by COVID-19.

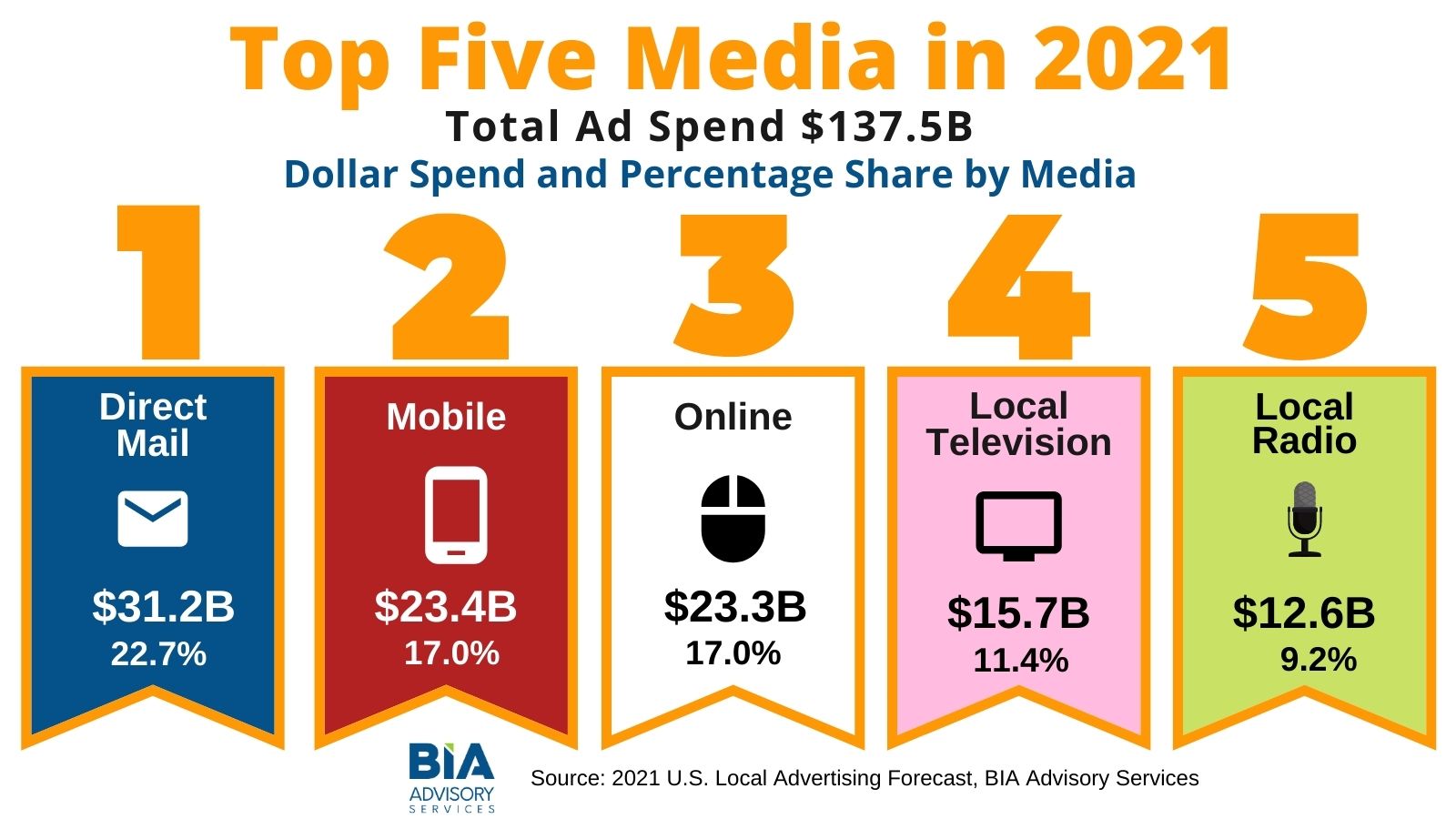

BIA estimates total local advertising revenue across all media in the U.S. will reach $137.5 billion in 2021.

This is up from its final post-COVID 19 estimate for 2020 of $134.1 billion, as it sees businesses start to adapt and rebound from the pandemic lows.

“As the expected presence of vaccines will help with the continuing rebound in the economy, we expect this increase will occur throughout 2021 even without the presence of significant political advertising,” BIA predicts.

In 2021, traditional media revenue will account for 55.3% of total local advertising at

$76.1 billion, a slight decline from 2020 levels. Digital media revenue will grow to $61.5

billion in 2021 to obtain 44.7% of total local media revenue, a share increase of 3.7% from 2020.

“Although we are estimating an overall increase in total local advertising next year, we do

not expect spending to recover to pre-COVID (2019) levels until 2022,” says Dr. Mark Fratrik, BIA’s chief economist. “The availability of a vaccine early in the new year will be a key factor to a much stronger year for almost all vertical advertising as the economy rebounds and consumers start moving around more freely and even going back into the office.”

BIA’s U.S. Local Advertising Forecast 2021 provides total nationwide spending estimates for

five years, along with 13 individual media forecasts.

The top predicted five media by dollar spend and percentage share for 2021 include:

- Direct Mail $31.2B (22.7%)

- Mobile $23.4B (17.0%)

- Online $23.3B (17.0%)

- Local TV $15.7B (11.4%)

- Local Radio $12.6B (9.2%)

Explaining the share of wallet between media, Fratrik commented, “This year saw a very strong shift into digital media for its lower costs, accountability, and flexibility. However, it

also included substantially improved targeting, attribution, and ROI tools from broadcast

TV, broadcast radio and MVPDs that cannot be ignored. Just as the pandemic had a significant effect on the local ad environment, it adjusted how we did our overall forecasting for 2021. Into the new year, we will continue examining the revenue generating opportunities of linear plus digital media activations in our forecasting models.”

Three key ad platform findings from the forecast were also offered by BIA.

Three key ad platform findings from the forecast were also offered by BIA.

Local television and local radio:

Both media will maintain their position in the top 5 media for 2021 in terms of ad spend and percentage.

Local television, the 4th leading media, is estimated to get $15.7 billion.

Local radio, the 5th leading media, will get $12.6 billion.

“Even with the onslaught of new digital competitors, these traditional media still retain sizable audiences that many national and local advertisers want to reach,” BIA says.

Local mobile and local online advertising:

Local mobile advertising will continue to get more of the local advertising pie. In 2020, $19.8 billion will have been spent on mobile and that will grow significantly to $23.4 billion in 2021. Collectively, local mobile and online will account for more than one-third of all local advertising.

Over-the-Top (OTT) Locally Activated Advertising:

OTT, with its strong showing for 2020, will continue to grow in 2021 as it provides targeted advertising capabilities with quality video programming. BIA estimates this ad platform will

grow from $1.0 billion in 2020 to $1.2 billion in 2021.

Rick Ducey, BIA Advisory Services Managing Director, comments, “The OTT TV and the Connected TV segment are game changers for the broadcast industry because it is now very easy to purchase fragmented inventory and do audience targeting. These improvements will help sellers better justify local OTT buying, and we expect local

audience share gained in Q2 and Q3 of 2020 will be maintained and expanded going

forward, presenting a tremendous opportunity for the industry.”