Good Morning - Thanks for your loyal RBR readership. Good Morning - Thanks for your loyal RBR readership.

RBR EPAPER - Gaining a personal edge on today's business day. Are you reading this from a forwarded email?

New readers can receive our RBR Morning Epaper for the next 30 Business days! SIGN UP HERE

|

|

|

|

|

Volume 22, Issue 236, Jim Carnegie, Editor & Publisher

|

Monday Morning December 5th, 2005

|

|

|

Radio News®

|

Clear Channel sets CCE spinoff Clear Channel sets CCE spinoff

Come December 21st Clear Channel Communications will be out of its unhappy venture into the concert business. The spin-off of Clear Channel Entertainment announced last spring (5/2/05 RBR #86) will be completed by distributing stock of CCE Spinco to existing Clear Channel shareholders. If you own Clear Channel stock, you'll get one share of Spinco for each eight shares of Clear Channel that you own. That won't be taxable. But for fractional shares of Spinco you'll receive cash (as yet undetermined), which will be taxable. Spinco is going to trade on the NYSE as "LYV" so look for the new name to be something like Live Entertainment.

RBR observation: Get your calculators ready. Come December 22nd we'll have a Wall Street valuation of what the Entertainment unit is worth - - and how much of Clear Channel's 4.4 billion investment has simply vanished into thin air.

Coen looks into his crystal ball this morning Coen looks into his crystal ball this morning

The US advertising environment wasn't looking so great when Bob Coen revised his 2005 ad spending forecast, mostly downward, back in June (6/3/05 RBR #128). Since then, things have gotten worse, not better, so look for the Universal McCann guru to have even lower final projections for 2005 when he speaks this morning at the UBS 33rd Annual Global Media Conference in New York and later in the day at a competing CSFB conference. Back in June Coen was still looking for local radio to be up 3.5% and national (network and spot combined) to gain 5%. Those targets appear far too high now, with the RAB reporting radio revenues flat through the first ten months of the year. Coen may also have to lower his projections that network TV would be up 2%, national spot TV down 5% and local TV up 2%. Coen's early projection for 2006 was for total US ad spend to rise 5.8%. We'll see if that holds up today and get his first detailed projection for each media sector. Here's what Coen had forecast for 2005 a year ago and his revision in June.

| View Coen's Chart |

Analyst sees Radio flat, TV down

Saying the RAB's reported 7% October drop in radio revenues (12/1/05 RBR #234) has made it impossible to have a positive number for Q4, Harris Nesbitt analyst Lee Westerfield is projecting that radio revenues will be flat for 2005 and then rise 3% in '06. He sees that growth coming from both political spending and the first anniversary of Clear Channel's Less is More initiative, creating easy comps after the year-ago inventory cuts by the radio giant. For spot TV, Westerfield sees a big impact from the two-year cycle of elections and Olympics, with '05 down 7%, then up 9% with next year's political/Olympic spending. For all of television (network, spot and syndication combined), the analyst says ad revenues could be up 8.5% next year, with four to five points coming from Olympics and political. But Westerfield says the big growth next year with be in Internet advertising, with the web capturing nearly a quarter of all increased ad spending. That would boost Internet advertising revenues by 37% in 2006, on top of 31% growth this year.

|

|

|

Internet advertising: Internet advertising:

A place for convergence?

Research firm eMarketer says advertising using video on the Internet will rake in 225M this year, and will nearly triple - - to 640M - - by the end of 2007, on its way to 1.5M annually by the end of the decade. eMarketer Senior Analyst David Hallerman says the key from broadcasters is to think of this development as an extension of what they already do, not as a new competitor. "Video represents common ground for television and the Internet, not a field of battle," he said. "Winner-take-all is not the name of the game." The firm provided a list of benefits offered by the category, including "...paid search, branded entertainment, viral marketing, consumer generated media, behavioral targeting, Web site brand marketing and online gaming." Hallerman explained how broadcasters and advertising agencies should be viewing this. "Now the products they are best at creating - - film and video commercials, or 'spots' - - can be transferred to a new medium, new markets. In real-world terms, what that means is marketing campaigns can extend TV's reach to the online space, enticing the target audience to spend more time with a particular brand. It also means using the Internet's ability to track consumers in ways that match up television commercials with online (and offline) activity. And it means combining the content offered on the tube with the control individuals take for granted on the Internet."

RBR observation: This advice applies to radio broadcasting just as much as it does to television, in our opinion. Broadcasters - - like everyone else in America - - are obviously taking the world wide web into account. It's a rare station or company which is operating without a website. The fact is, many companies, not the least of which is the one whose primary product you are now reading, have had their core business model utterly transformed by the Internet. (Paper? Ink? Printing press? Big Postage? What are those?). The key piece of advice here is to stay on top of developments daily, and make sure the Internet is your partner, not the 800-pound gorilla that has you for lunch.

The Rehr era begins today The Rehr era begins today

It's been six weeks since his selection was officially announced (10/21/05 RBR #207), but today's the day that David Rehr actually moves into the President/CEO office at the National Association of Broadcasters. No doubt he's been preparing to hit the ground running, with the NAB deeply involved in lobbying over such hot issues as indecency, cable must-carry, newspaper-broadcast crossownership, broadcast ownership limits...and the list goes on and on.

RBR observation: Broadcasters may not know Rehr yet, but the important thing is that Senators, Representatives and staffers on Capitol Hill do. He's been fighting the good fight for the beer industry and will now speak for broadcasters. We hope he'll be able to persuade Viacom, News Corp. and NBC Universal to rejoin the NAB, as Disney/ABC has done, so the industry can again speak with one voice. We would say something about how we'll miss Eddie Fritts, who had a great run of over two decades heading the NAB - - but we don't think he's going away. Rather, we expect to soon be reporting on his re-entry into station ownership. Have you signed up yet to get your daily Epaper, Eddie?

|

|

|

|

|

Adbiz©

|

WorldLink partners with Interep

for direct response dollars

WorldLink and Interep have formed a partnership that will extend WorldLink's direct response advertising resources to include Interep's 1,500 client radio stations. WorldLink represents more than 200 national, regional and international cable networks, broadcast stations and syndicators. WorldLink specializes in direct response, syndication and general market advertising sales in various capacities in North America, Europe, Latin America and Asia.

| Read More |

RBR observation: In the new world of ROI goals and accountability, direct response is accountable by nature. So the more that Interep and WorldLink can target these ads to specific consumers, the more measurable and efficient the buys will be.

Merrill Lynch cuts ad spend forecasts Merrill Lynch cuts ad spend forecasts

Pressure on ad rates in traditional media, along with potential weakness in the automotive and entertainment industries, could slow down ad spending growth both this year and next, according to Lauren Fine of Merrill Lynch in her annual advertising update. The report says the industry is likely to under perform the gross domestic product and Fine lowered her U.S. ad spending forecast to 3.2% growth in 2005 from a previous 3.7%. She cut her 2006 estimate to 4.5% from 5.2%. Excluding junk mail, her ad forecast is for 2.3% growth in 2005 and 4.5% in 2006. "If realized, our 2006 forecasts would imply a second consecutive year of underperformance of ad spending relative to GDP growth, despite the expected influx of political and Olympics advertising next year," MarketWatch quoted her as saying. "Along with corporations' cautious attitude towards ad spending in an uncertain environment, we think the emergence of the Internet & other newer forms of marketing is allowing advertisers' dollars to work harder with more measurability. This greater efficiency has capped the ability of traditional media companies to raise ad rates." Auto ad spend in particular will go flat in 2006, according to the report, which predicted automakers' U.S. spend in 2006 will be flat at 11.5 billion, following an estimated rise of 6% to 11.4 billion this calendar year. While there are financial right now with GM and Ford in the midst of cutting staff and production, the report says there's no reason to believe auto ad spend will fall. The main reasons? Heavy new model launches; a more competitive market and brand-rebuilding strategies.

|

|

|

|

| Media Markets & MoneyTM |

Seven down, 43 to go: Amador busts into Colorado

Amador Bustos's ever-growing Bustos Media has added a key market with an agreement to LMA and purchase KKCS-FM. Although licensed to Colorado Springs, Bustos notes that the station carries all the way south to Pueblo and, more importantly, northward it passes through and past Denver all the way to Longmont. According to Bustos's broker, Chuck Lontine of Marconi Media Ventures, the price is 18.5M. Tom Gammon of Americom represented seller Superior Broadcasting of Denver, headed by Chris Devine. It marks the second transaction between the two companies, following a 2004 deal in which Devine sent a pair of Salt Lake City stations to Bustos. Lontine notes that Bustos was on hand personally to flip the station to Regional Mexican last Friday afternoon, using his group's signature "La Gran D" format under terms of an already up-and-running LMA. Plans to apply matching KGDQ call letters await FCC approval. Bustos is based in California, and along with Utah and Colorado, it's established a presence in Oregon, Idaho, Wisconsin and Washington state. Bustos was pleased with the move, to say the least. "Denver is a dream market for us. We are elated to be able to serve the15th largest and one of the fastest growing Hispanic markets in this wonderful metropolitan area."

October a downer for Tribune

Advertising revenues were down for both print and broadcast in October at Tribune Company. TV revenues were down 8.6% to 100.2 million, blamed on weakness in automotive, retail and telecom. Radio/Entertainment revenues rose 7.6% to 7.1 million, but the gain was attributed to increased revenues for the Chicago Cubs baseball team. All in all, Broadcasting & Entertainment revenues were down 7.7% to 107.3 million. Classified advertising was up 1.6% for the newspaper division, but retail fell 3.3% and national dropped 6%, for a 2.4% overall decline in ad revenues to 262.6 million. Circulation revenues were also down, so total print revenues fell 2.7% for the month to 329.5 million.

EMF moves into Quad Cities

Educational Media Foundation is still snagging property. It's latest filing will involve another foray into unreserved territory - - and although the general targeted age group may be the same, it figures to include a major programming change for an All-Hits Rock Island IL FM station. The station is WHTS-FM, owned by Van Archer's Mercury Broadcasting Company. EMF will pay 3.5M for the station, which likely will follow in the path of dozens of other EMF properties, into the K-LOVE Contemporary Christian Network.

It takes a Connoisseur to appreciate

shadow Superduopoly

The faintest of superduopolies has been formed in Billings MT by Jeff Warshaw's resurgent Connoisseur Media. Up until last week, it was a silent duop, formed by a pair of unbuilt Auction No. 37 FM CPs. That pairing has now been augmented by KLZY-FM, which - - ironically, Connoisseur doesn't own. Rather, it will run the station in an LMA with owner Jerrold Lundquist's Chapparal Broadcasting. According to the FCC database, KLZY is currently licensed to Powell WY but is approved to move to Park City MT, just west of town along I-94. Connoisseur's CPs are for sticks in Lockwood and Joliet, also withing range of Billings. Warshaw has two stations up and running in the Bloomington IL market, and other under contruction in Omaha, Des Moines, Rapid City, Huntington-Ashland and Wichita.

|

|

|

|

| Washington Beat |

Public group greases wheels for scholarly FM

Conventry Rhode Island Public Schools was seeking renewal of its license for 91.5 mHz WCVY-FM (Conventry RI is its city of license). However, the school district is not interested in running the station 24/7, and it especially isn't interested in having to run it over the summer and during other long vacation breaks. Educational Radio for the Public of the New Millennium (ERPNM) has stepped up to the plate, agreeing to a channel-sharing arrangement which will place a second station on the same frequency, in this case licensed to East Greenwich RI. Under the agreement, Schools will be on the air from 2PM-10PM weekdays, and ERPNM will fill the day out, picking up at School's 10PM sign-off, and continue overnight, through the morning, and through noon to 2PM when School comes back. ERPNM will also fill the airwaves 24/7 during weekends and vacation periods. The FCC has approved the arrangement, informing both parties to make sure they have accurate up-to-date information on School's hiatus periods available in their respective public folders.

Alito ads diverge on venue, budget Alito ads diverge on venue, budget

Hearings on Supreme Court nominee Samuel Alito are not scheduled until we flip the last page of the 2005 calendar, a fact which hasn't stopped at least a handful of interest groups to buy airtime to voice their views on the subject. According to Brennan Center for Justice at New York University School of Law and the Justice at Stake Campaign, one pro-Alito group - - Progress for America - - has outspent those against his nomination by a factor of three, almost. It has also tried to reach a national audience by placing about 308K worth of business with selected cable networks. A different tactic has been employed by a pair of anti-Alito groups: People for the American Way and Independentcourt.org. They've placed about 119K in states represented by key Judiciary Committee senators, such as Maine and Rhode Island. Brennan Center says only a token amount has gone to cable. Taking into account the prior ad wars over the Roberts and Meirs nominations, conservative groups have spend about twice as much as liberals. The Brennan Center relies on data from TNS-Media Intelligence/CMAG.

RBR observation: It goes without saying that the intensity of the air wars should pick up in January. It'll be like a preseason game before the real political category action picks for next fall's midterm elections.

|

|

|

|

| TVBR - TV News |

Swords drawn over a la carte Swords drawn over a la carte

In no uncertain terms, Kyle McSlarrow of NCTA opposes mandating an a la carte menu option for cable subscribers, saying it could increase prices, decrease diversity and impinge on CATV broadband deployment. But Cablevision honcho Charles F. Dolan came out in support of the measure and MVPD wannabe AT&T also expressed a favorable opinion. A la carte has become a hot topic since FCC Chairman Kevin Martin told the Senate Commerce Committee that his agency was about to reverse a Michael Powell-era report finding problems with the concept - - instead, it would put forth the concept as a possible option to be explored along with offering subscribers the choice of family-friendly channel tiers or applying broadcast decency regulations to basic cable services. +McSlarrow found much to dislike in the a la carte concept, and repeated his opinion that its imposition would be unconstitutional. The Los Angeles Times also waded into the fray, backing a la carte, in particular to head off extending broadcast content regulation to cable. Dolan countered that such a program could be beneficial to operators, programmers and subscribers. An AT&T spokesperson told Reuters that it would be more than happy to offer such an option to subscribers provided it is not forced to accept bundled program packages from distributors.

TVBR observation: And that last is one of the big rubs. Matt Polka of the American Cable Association told the Commerce Committee that the small operators he represents would be more than happy to tailor program lineups to suit parents who don't want certain channels coming into the house. The problem, he said, is programming conglomerates with must-have channels, which refuse to make them available unless some weak-sister channels are taken as well. While this sort of force-feeding helps one conglomerate compete against another conglomerate, it is extremely anti-competitive for an independent or less-conglomerated programmer who finds those same weak-sister offerings hogging channel capacity - - making it impossible for an indy to even begin to find an audience. Of course, it may not matter how this all turns out - - the very real possibility exists that the Internet may make broadcast and fixed schedule MVPD business models obsolete anyway...

| McSlarrow and Dolan statements are here |

Networks get passing diversity grades

But not great grades, in the opinions of Hispanic and Asian media watchdogs. The Asia Pacific American Media Coalition gave the four big broadcast networks C grades in terms of their hiring of Asians both in front of and behind the cameras during the 2004-2005 season, but said that represented a bit of backsliding from the previous year. Fox and NBC got actual Cs, book ended on the positive side by ABC with a C+ and CBS with a C-. The National Hispanic Media Coalition was more upbeat, giving ABC a B and handing out C+s all the way around for the other three networks. ABC provided a lot of work for Hispanic actors via two shows in particular, "The George Lopez Show" and "Freddie." Of the two report cards issued by the groups, the grades trended higher for Hispanics. An NAACP report on African American TV employment trends is expected early in 2006.

| Read the report cards |

|

|

|

|

| Monday Morning Makers & Shakers |

|

Transactions: 10/24/05-10/28/05

October was a fairly robust trading month, starting out with a TV-fueled bang and moving along nicely after that on the radio side, only to hit a lull in the last full week before Halloween. Two sales involving five top-50 market AM stations provided most of the value.

|

|

Total

|

|

Total Deals

|

11

|

|

AMs

|

8

|

|

FMs

|

10

|

|

TVs

|

1

|

| Value |

39.28M

|

| Complete Charts |

|

Radio Transactions of the Week

One sale, two markets, three stations

| More... |

|

TV Transactions of the Week

SC CP tags along late

| More... |

|

|

|

|

|

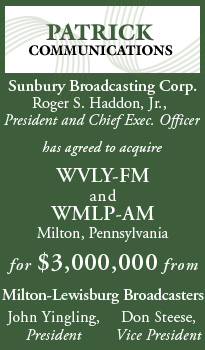

| Transactions |

1M WNUY-FM Bluffton IN from Wells County Radio Corporation (Joe Shanley) to Independence Media of Indiana LLC (David F. Jacobs et al). 25K deposit, balance in cash at closing. [File date 11/14/05.]

350K KVSF-AM Santa Fe NM from AGM Nevada LLC, a subsidiary of American General Media (L. Rogers Brandon) to Hutton Broadcasting LLC (Edward B. Hutton Jr., Georgie S. Hutton). Promissory note. Combo with KQBA-FM Los Alamos NM. LMA 9/1/05. [File date 11/10/05.]

|

|

|

|

| Stock Talk |

Wall Street enthusiasm cools off

Good news on the jobs front wasn't enough to put Wall Street traders in a buying mood on Friday, amid concerns about energy prices and what the Fed may do. The Dow Industrials fell 35 points to 10,877, but it was a mixed day, with other broad indices slightly higher.

Radio stocks slipped a bit. The Radio Index dipped 0.924, or 0.5%, to 189.849. Spanish Broadcasting System, which fell into penny stock territory last week, dropped another 2.4% Friday. Entravision was off 2%.

|

|

|

|

| Radio Stocks |

Here's how stocks fared on Friday

| Company |

Symbol |

Close |

Change |

Company |

Symbol |

Close |

Change |

|

Arbitron

|

ARB

|

|

39.77

|

+0.06

|

Jeff-Pilot

|

JP

|

|

56.15

|

unch

|

|

Beasley

|

BBGI

|

|

14.06

|

-0.16

|

Journal Comm.

|

JRN

|

|

13.65

|

-0.14

|

| Citadel |

CDL |

|

13.81 |

+0.03 |

Radio One, Cl. A

|

ROIA

|

|

11.19

|

+0.08

|

|

Clear Channel

|

CCU

|

|

33.02

|

-0.06

|

Radio One, Cl. D

|

ROIAK

|

|

11.21

|

+0.10

|

|

Cox Radio

|

CXR

|

|

15.05

|

+0.05

|

Regent

|

RGCI

|

|

4.93

|

-0.01

|

|

Cumulus

|

CMLS

|

|

12.30

|

-0.13

|

Saga Commun.

|

SGA

|

|

12.11

|

-0.15

|

|

Disney

|

DIS

|

|

24.88

|

-0.08

|

Salem Comm.

|

SALM

|

|

19.16

|

+0.15

|

|

Emmis

|

EMMS

|

|

20.99

|

+0.06

|

Sirius Sat. Radio

|

SIRI

|

|

7.12

|

+0.01

|

| Entercom |

ETM

|

|

32.28

|

-0.42

|

Spanish Bcg.

|

SBSA

|

|

4.55

|

-0.11

|

|

Entravision

|

EVC

|

|

7.30

|

-0.15

|

Univision

|

UVN

|

|

30.42

|

+0.15

|

|

Fisher

|

FSCI

|

|

45.44

|

-0.28

|

Viacom, Cl. A

|

VIA

|

|

34.50

|

+0.68

|

|

Gaylord

|

GET

|

|

44.60

|

-0.38

|

Viacom, Cl. B

|

VIAb

|

|

34.47

|

+0.71

|

|

Hearst-Argyle

|

HTV

|

|

24.12

|

+0.11

|

Westwood One

|

WON

|

|

18.21

|

-0.06

|

|

Interep

|

IREP

|

|

0.37

|

-0.03

|

XM Sat. Radio

|

XMSR

|

|

29.56

|

-0.51

|

|

|

|

|

|

|

Bounceback

|

We want to We want to

hear from you.

This is your column, so send your comments and

a photo to [email protected]

|

|

|

Below the Fold

|

Ad Biz

Merrill Lynch cuts ad spend forecasts

Pressure on ad rates in traditional media could slow down spending both this year and next ...

Media Markets & Money

October a downer for Tribune

Ad revenues were down for both print and broadcast ...

Washington Beat

Public group greases wheels

For scholarly FM but not interested in running the station 24/7...

Shakers & Makers

Radio

One sale, two markets, three stations

TV

SC CP tags along late

|

|

|

Radio Media Moves

|

Berger exits Emmis Berger exits Emmis

Walter Berger has resigned as CFO of Emmis Communications, effective in January. He had been the company's CFO since 1999 and there was no immediate word on where he's going. As it begins the search for a new Chief Financial Officer, Emmis has named Emmis Radio VP/Finance and Controller David Newcomer as interim CFO of the entire company.

Cox Radio Tulsa announces National Sales change

A change in its national sales management structure as Mike Murray, Cox Radio/Houston's National Sales Manager, has added the responsibility for handling national sales for Cox Radio/Tulsa's five station cluster. Stations affected include News/Talk 740 KRMG, country station KWEN, classic rocker KJSR, adult contemporary KRAV and Tulsa's newest station, Christian A/C Spirit 102.3 KKCM. Prior to joining Cox Radio Houston in 2000 as National Sales Manager, he held positions as Local Sales Manager, General Sales Manager, and Director of Sales in Television.

McKinley to the

Garden State

Greater Media has named Nancy McKinley as Station Manager of WMTR-AM & WDHA-FM Morristown, NJ.

Two new AEs

WCOJ-AM Coatesville-West Chester, PA announced that James Conroy and John K. King II have joined the suburban Philadelphia station as Account Executives.

Folta to do double duty

When Viacom splits into New Viacom and CBS Corp. later this month, Carl Folta will have two new jobs. He'll take the new title of Executive Vice President of the Office of the Chairman, serving as the "chief representative" of Chairman Sumner Redstone for both companies. He has been Exec. VP of Corporate Relations for Viacom.

|

|

|

Stations for Sale

|

NYC Prime Radio

Time for Lease

7 days a week available p/t-f/t Business, Foreign language, religious, Health, Infomercials accepted. 212-769-1925 [email protected]

TV & Satellite time also available. Station Inquiries welcome

|

|

|

December '05 RBR/TVBR Solutions Magazine

|

As a Professional courtesy and your convenience we have produced our December Solutions Magazine in PDF Format to Save on your Desk Top to archive. This requires version 6.0 or later of Adobe Acrobat Reader.

Use this button to update today and look for Santa on Tuesday December 6th. Use this button to update today and look for Santa on Tuesday December 6th.

|

|

|

RBR Radar 2005

|

|

Radio News you won't read any where else. RBR--First, Accurate, and Independently Owned.

|

Citadel move working - Nope

After falling out of favor with Wall Street as growth stocks, public radio and TV companies have been trying to reposition themselves as a value proposition - - delivering big rewards to investors by using their cash flow for dividends and stock buybacks. Is it working? Not so far.

RBR observation: It's almost unbelievable that you can buy Citadel stock for around 13.70 and get 72 cents a year in dividends - - and Wall Street isn't biting. A yield of 1.6-2% for CBS, depending on how post-split trading goes, isn't nearly as enticing. It will be interesting to see whether Sumner Redstone's gamble pays off. He could be left with a New Viacom that doesn't get valued any higher than the old Viacom - - and a CBS that drops even lower.

12/02/05 RBR #235

Infinity may sell,

Clear Channel won't

CEO John Hogan when asked if they are selling stated "We do not have plans to divest," But soon-to-be CBS CEO Les Moonves took a different view. He said the company's Infinity Broadcasting might look at "trimming" some of its smaller markets. RBR observation: Rolling like thunder into 2006 we bet attitudes will change dramatically on what assets to keep and what to cut. Assets made up of people running them are like Animals - they need food to grow and you can't feed equally. RBR will archive all these quotes from CEO's and see how they read as the new year goes into full gear.

12/02/05 RBR #235

October no treat for radio

Crystal ball gazers had been predicting that October would be a tough month for radio and Bingo - they were correct. RBR observation: Can this really all be blamed on the political category? The other big factor, of course, is Clear Channel's Less is More initiative, which has the industry giant lagging the rest of radio as it works to get its house back in order. In other words - So Goes Clear Channel so goes the business. Start to think independently and stop following a so-called leader. If not it will not be any better next year.

12/01/05 RBR #234

Think Radio has problems; Hearst-Argyle CBS comp to end

Renewed the affiliation agreements for its two CBS affiliates but the comp is gone. Now figure out how to replace that extra 1 million yearly. TVBR observation: Glad this is on the record as next phase could be reverse compensation - like the affiliates paying the networks for their content. Do not be surprised at this statement as Content is King. TV is going through pains as radio has over the past few years and this pain will not end in the near future.

12/01/05 TVBR #234

Senate decency bill

literally put on hold

Senate Commerce Committee Chairman Ted Stevens (R-AK) said some think it goes too far, others not far enough. Given that concern was coming from two opposite directions, Stevens did not think he had the 60 votes necessary to force action. RBR observation: We call it Beltway BS. 11/30/05 RBR #233

Reese makes the case

for broadcasters

Bruce Reese took exception to the apparently widespread belief that broadcasters are filling the airwaves with filth. "To begin," he said, "it may be useful to remember that the vast majority of broadcasters have never had the FCC take any action against them on the indecency issue." Read Reese's full testimony here

11/30/05 RBR #233

Wide open "Open Forum

on Decency"

A lot of ideas were put forth at the special session of the Seante Commerce Committee put together by Chairman Ted Stevens (R-AK). While it can probably be said that all in attendance believe that it is important to protect children from objectionable material that is pretty much where the consensus ended. Comments on decency read here

11/30/05 RBR #233

|

|

|

|

|

Account Executive - Suburban, NYC

It is Star 99.1, NYC's only Contemporary Christian music station. We look for overachievers with significant radio sales experience and offer base salary, commission, benefits and a positive environment. Giving you the tools to do your job to succeed. See Radio Careers

Sales and Marketing

Executive sought by rapidly growing participatory Television Company. Experience selling innovative programming to cable operators and programming executives across the United States with all aspects of the launch and rollout of a new program offering. Building a sales team and managing with their peers in the company. Prior relevant experience is a requirement. Competitive salary, benefits and stock options.

See TV Careers

|

|

|

|

|

|

Help Desk

|

Having problems with our epapers?

Please send Questions/Concerns to:

[email protected]

If you wish to remove your name completely from our database use this link __UNSUB__

RBR Epaper --  108 annual 108 annual

or just  9 a month 9 a month

|

|

|

|

©2005 Radio Business Report, Inc. All rights reserved.

Radio Business Report -- 2050 Old Bridge Road, Suite B-01, Lake Ridge, VA 22192 -- Phone: 703-492-8191

|

|